Mixed bag of economic flashes in Euro area, Inflation back in negative territory, GDP misses forecasts

Macro Outlook:

Euro zone GDP growth outperforms the US and UK in Q1 but reduced from its previous prints and misses forecasts, prints at 0.5% (Q1) versus 0.6%, supported by strong domestic demand

Growth is set to moderate in Q2, however, while annual headline inflation has returned to negative territory.

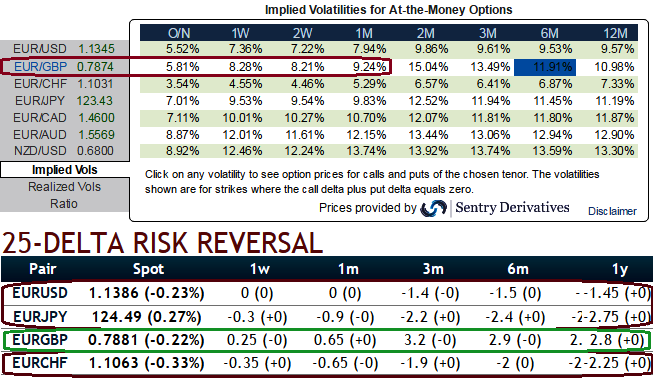

But, the current dynamics open the door to further EUR/GBP downside towards 0.7750 or below.

Expression - Sell downside volatility before the risk event (see IVs for 1W, 2W & 1M tenors).

The ECB is focusing on implementing existing stimulus measures for now, but more easing is possible later in the year.

Given the remaining uncertainty and the conditional nature of the event, a tactical bearish trade should be implemented via options.

Volatility is likely to gradually normalize approaching the vote, accompanied by GBP topside momentum and some deflation of the risk premium.

We favour the 6w expiry to benefit from the current unwind, thus avoiding direct exposure to the outcome and enjoying better liquidity on the volatility market.

Mechanics:

Buy EUR/GBP 1M put spread 1x2, strikes 0.77/0.75

Indicative offer: 0.58% (spot ref: 0.7750)

This put spread ratio positions meant for a moderate downside move and will benefit from further normalization in the volatility space.

The structure generates leverage between 4x and 5x if the spot trades close to the 0.75 strike at the 4w expiries.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data