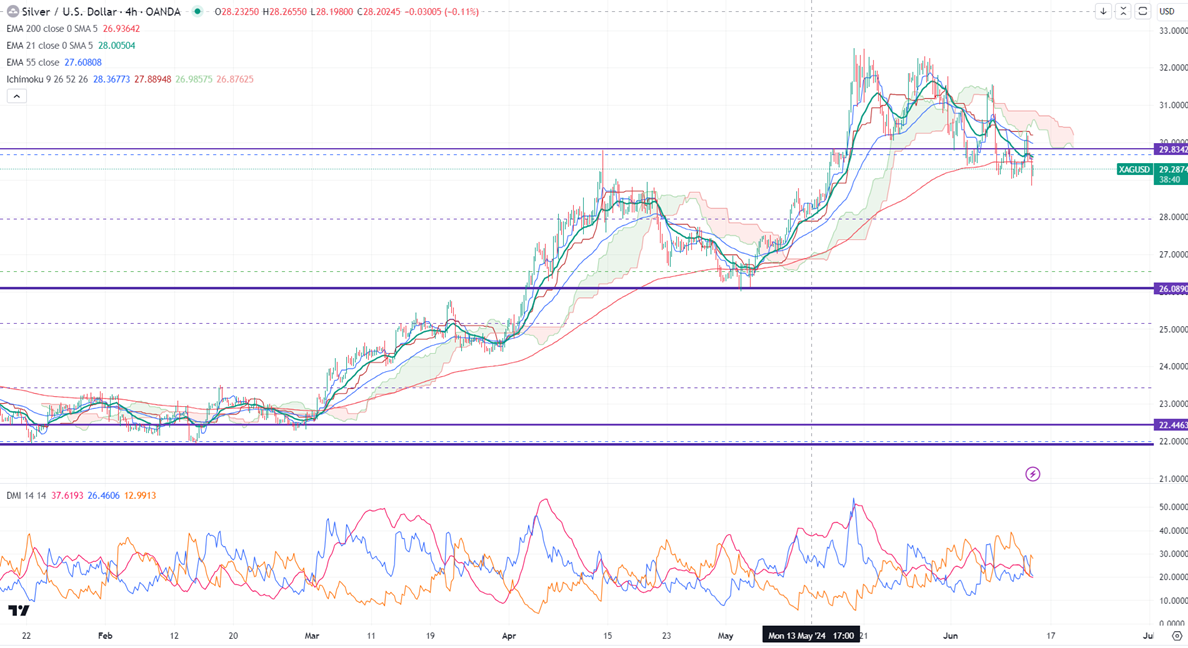

Ichimoku analysis (4-hour chart)

Tenken-Sen- $29.55

Kijun-Sen- $30.19

Silver pared some of its gains after Fed hawkish shift. It hit a low of $28.84 yesteerdayand is currently trading around $29.348.

Precious metal gained momentum after weak US CPI. The upside is capped due to hawkish stance by Fed. The central bank hints at 25 bpbs rate cut by 2024.

Geopolitical tension in the Middle East and France supports Silver price at lower levels.

Markets eye US PPI and Initial jobless claims for further movement.

Gold-silver ratio-

Gold/Silver ratio- 78.74. The silver gained midly as Gold/Silver ratio rebounded from 73.11 to 79.08, well above the historical average of 52. So silver will outperform gold. It is good to buy silver at lower levels compared to gold.

Major trend reversal level -$32.50

It trades below 21 and above 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $28.80 and a break below the target of $28.30/$27.90/$27. On the higher side, immediate resistance is around $30 and any breach above targets is $30.70/$31.50/$32/$32.50.

It is good to sell on rallies around $29.45-50 with SL around $30 for TP $27.90.