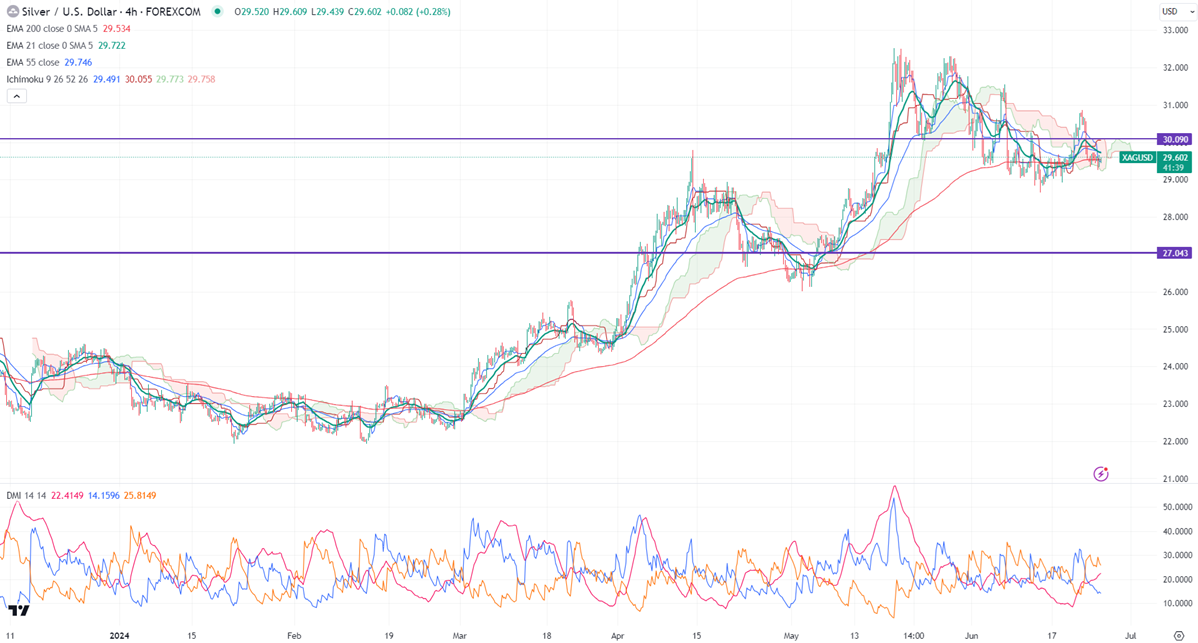

Ichimoku analysis (4-hour chart)

Tenken-Sen- $29.49

Kijun-Sen- $30.05

Silver trades weak despite the weak US dollar. It hit a low of $29.25 yesterday and is currently trading around $29.58.

Dovish comments from the Fed Reserve of Chicago President Austan Goolsbee prevented silver from a further sell-off.

Markets eye CB consumer confidence and Richmond manufacturing index for further direction.

Gold-silver ratio-

Gold/Silver ratio- 77.80. The gold-silver increased from 76.77 to 7.79 as gold performed well compared to silver, well above the historical average of 52. So silver will outperform gold in the long run. It is good to buy silver at lower levels compared to gold.

Major trend reversal level -$28.80

It trades below 21 and 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $30 and a break below the target of $29.25/$29. On the higher side, immediate resistance is around $31 and any breach above targets is $31.50/$32/$32.50.

It is good to buy on dips around $29, SL at around $28.65, and TP at $30.