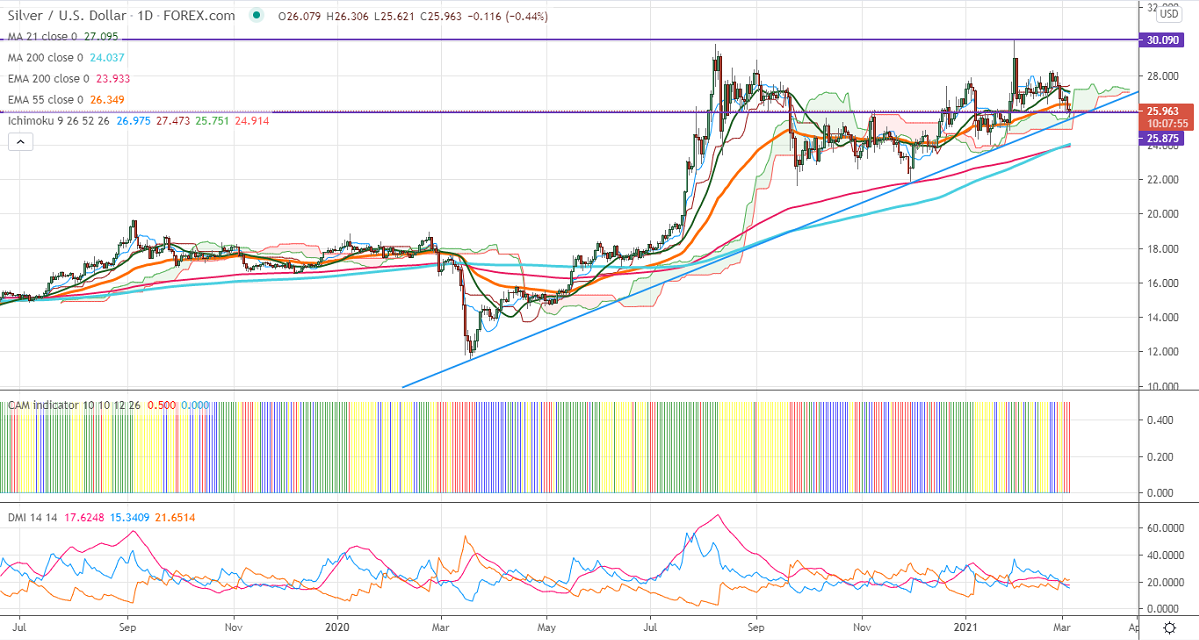

Ichimoku analysis (Daily chart)

Tenken-Sen- $27.08

Kijun-Sen- $27.39

Silver continues to trade lower for third consecutive days and lost more than $1 on surging US bond yield. The US 10-year bond yield jumped more than 8% from a minor bottom 1.39% on improvement in scale of vaccination. Short term trend is still bearish as long as resistance $27 holds. Silver was one of the worst performers in the previous month and declined more than 4.5%. According to ADP, the number of private jobs added by 117000 in Feb compared to a forecast of 203k. The US SIM services came at 55.3 in Feb vs an estimate of 58.70. DXY is trading well above 91 levels. Primary bullish continuation only above 91.60 levels.

Technically, silver's significant support is around $25.90, violation below will drag the pair down to $25.36/$25/$24. The near-term resistance is at $27, any surge past targets $27.35/$28/$28.30 is possible.

It is good to sell on rallies around $26.45-50 with SL around $27 for TP of $24.