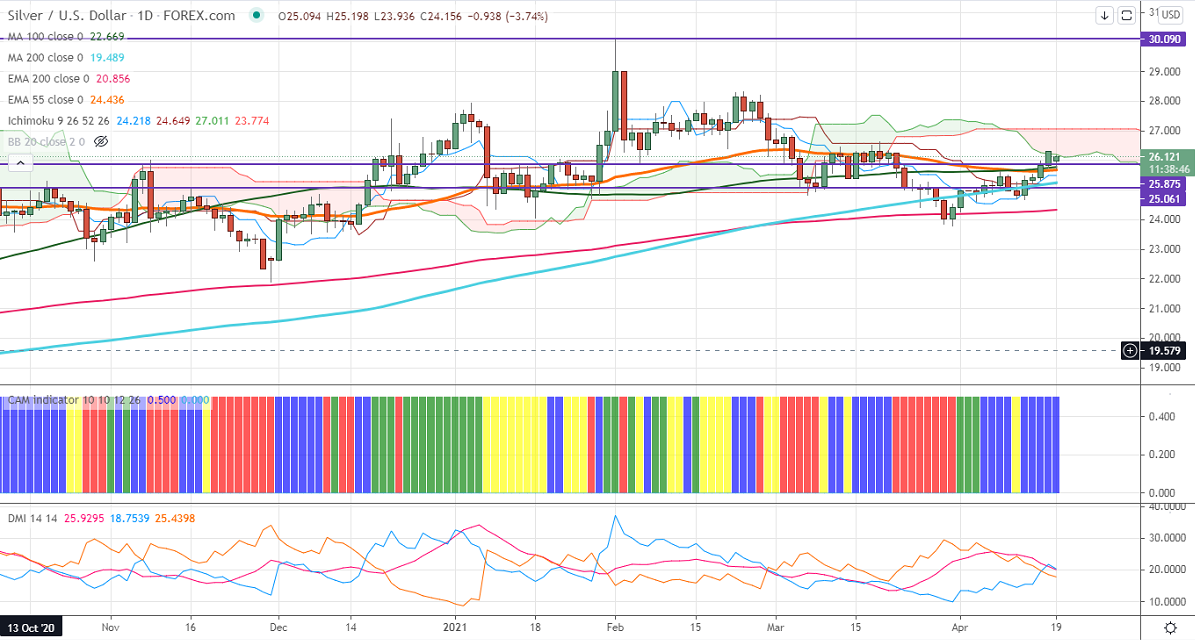

Ichimoku analysis (Daily chart)

Tenken-Sen- $25.49

Kijun-Sen- $25.20

Silver is trading higher for fifth consecutive days and surged more than 6.5% on broad-based US dollar selling. DXY has formed a temporary top around 93.43 and lost more than 120 pips. The decline in US bond yield is also supporting precious metals. The University of Michigan sentiment index rose to 86.5in Apr vs a forecast of 89.6.

Silver was one of the worst performers in the past two months of this year and lost more than 20%. It hits an intraday high of $26.16 and is currently trading around $26.10.

Technically, silver's significant support is around $25.75 (100- day MA), violation below will drag the pair down to $25.45/$25.25/$25. Significant bearishness can be seen only if it breaks below $24.60.The near-term resistance is at $26.30, any surge past targets of $26.65/$27 is possible.

Indicator (Daily chart)

CAM indicator –Slightly bullish

Directional movement index – Neutral

It is good to buy on dips around 25.60-65 with SL around $25.15 for TP of $27.