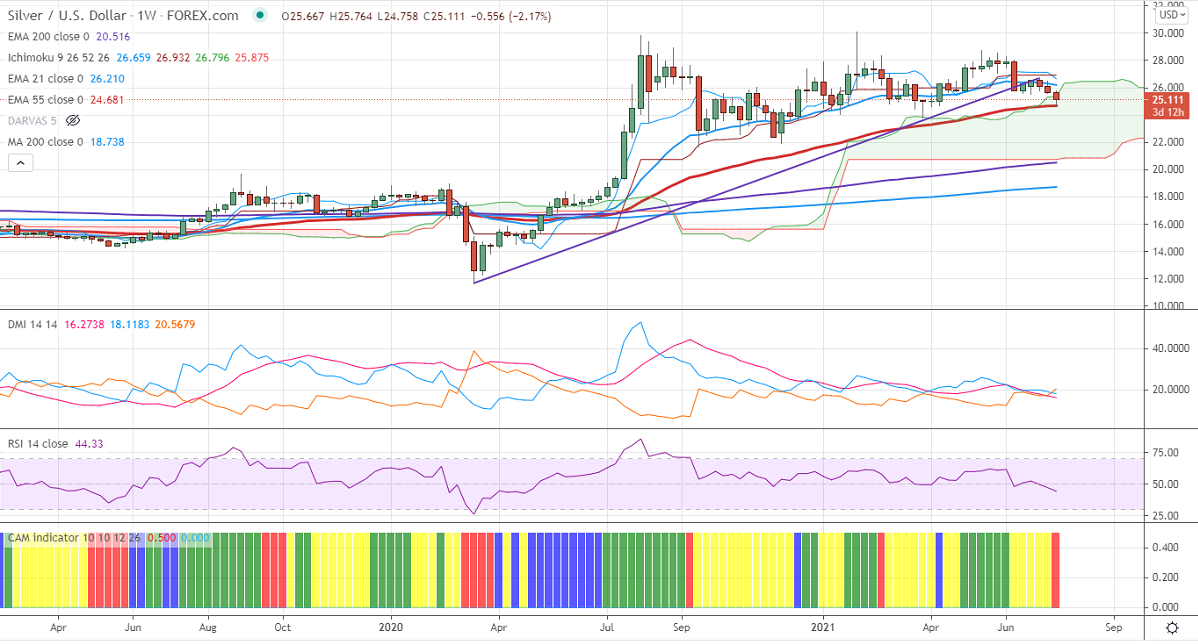

Ichimoku analysis (Weekly chart)

Tenken-Sen- $27.13

Kijun-Sen- $26.92

Silver continues to trade weak for the past three consecutive weeks and lost more than 7% on board-based US dollar buying. The commodity was one of the worst performers in past one month despite weak US bond yields. The US 10-year yield showed a sell-off of more than 35% in the past 3-1/2 months.

Markets eye US jobless claims and European Central Bank monetary policy for further direction.

Technically, silver's significant support is around $24.65 (55 W EMA), close below will drag the pair down to $23.78/$23. Significant bearishness happens if it breaks below $21.89.The near-term resistance is at $26.50, any surge past targets of $27/$28/$28.75 (May month high) high). Significant bullish continuation only if it breaks $30.

Indicator (Daily chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to sell on rallies around $25.70-75 with SL around $26.75 for TP of $23.85/$21.90.