We continue to think there are downside risks to MAS's forecasts that core CPI inflation will rise over the course of 2016 from 0.5% to 2.0% and headline inflation to range -0.5% - 0.5%. Likewise, its forecast for GDP growth to expand from 1.4% to 2-2.5% in 2015 and 2016 seems optimistic given the slowdown in China, Malaysia and the EU, its top three trading partners (representing a combined 32% of total trade).

In today's report, Statistics Singapore said that Singaporean Industrial Production fell to an annual rate of -7.9% vs forecasts at -7.0%, from -6.4% in the preceding month whose figure was revised down from -5.5%.

Final Q3 GDP growth was revised up from 1.4% to 1.9%. We don't think this will feed through into Q4 GDP growth. Annual non-oil domestic exports growth contracted (-3.3%, cons: 1.5%) and annual electronic exports growth grew much slower than expected (0.7%, cons: 5.2%).

SGD was among the top five performers in Asia during December (+0.89% against USD) but New year series has been disappointing for again SGD. We remain puzzled by SGD's resilience in spite of the continued disinflationary pressure. October CPI inflation undershot expectations and fell unexpectedly. Headline inflation fell from 0.6%y/y to -0.8% (cons: -0.4%). Core CPI inflation fell from 0.6%y/y to 0.3% (cons: 0.6%).

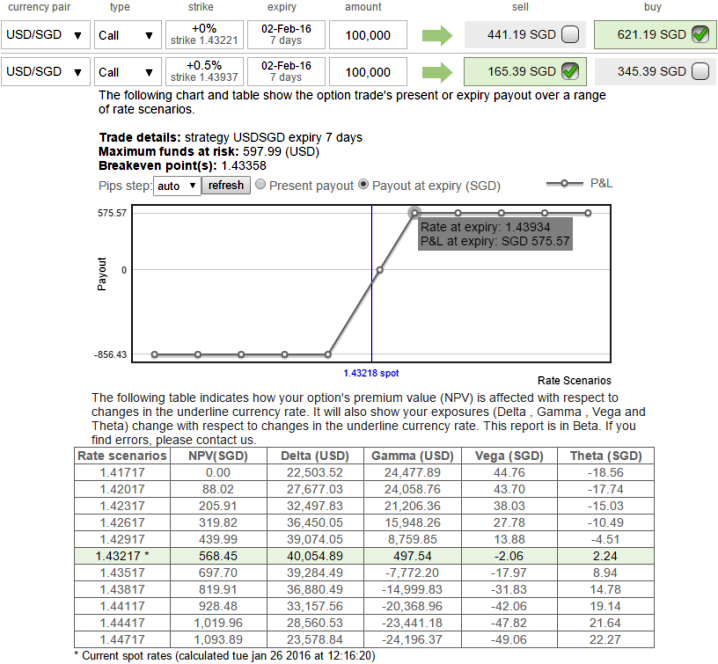

So to hedge SGD's uncertain trend, here goes the strategy: 2W (0.5%) in the money 0.66 delta calls and 4D (0.5%) out of the money calls with positive theta and prefer delta close zero.

The ideal situation for the diagonal bull call spread buyer is when USDSGD price to remain unchanged within shorter expiries on short side and only spikes up & beyond the strike price of the call sold when the long term call expires, as we expect USDSGD's fluctuations to remain within range or not dramatic upswings in next immediate future (in next 3-4 days).

In this scenario, as soon as the short call expires worthless, the options trader can write another slightly OTM call and repeat this process every month until expiration of the longer term call to reduce the cost of the trade. It may even be possible at some point in time to own the long term call "for free".

Under this ideal situation, maximum profit for the diagonal bull call spread is obtained and is equal to all the premiums collected for writing the short calls plus the difference in strike price of the two call options minus the initial debit taken to put on the trade.

FxWirePro: Singapore’s tepid IP number trims SGD gains – deploy diagonal debit bull spreads for hedging

Tuesday, January 26, 2016 6:59 AM UTC

Editor's Picks

- Market Data

Most Popular