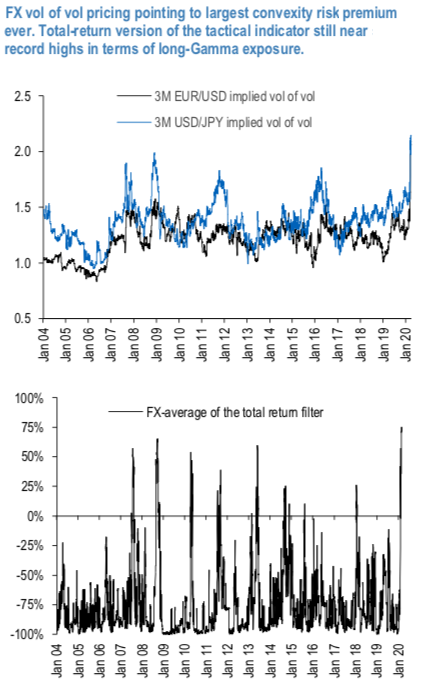

The rather extreme conditions as experienced by the FX vol market are confirmed when looking at the so-called vol-of- vol parameters, a measure of convexity smile risk for different pairs (Exhibit 2, top). While pricing of vols remains generally well below that observed at the 2008 highs, this measure of convexity risk largely overshoots, at least for liquid pairs, the previous peak which took place at the peak of the 2008 GFC.

This picture is fully consistent with the results of a tactical model for vol trading (Total-return version of tactical filter allowing long Gamma trades), whose recommended long-Gamma signals is highest on record (refer 1stchart), after averaging over USD G10 and EM pairs, again surpassing the GFC and European debt crisis. The model relies on a set of common global indicators and other variables that depend on each vol smile. At present, 4 of the global indicators (Ted spreads, VIX, Gold/Silver and VXY) indicate a risk-off market, with only US swaptions pointing to benign sentiment.

The model had started deleveraging risk towards mid- February, before going overall long Gamma, between end of Feb – early March, depending on the currency.

By construct the model cumulates positions over a month (each trade is kept until expiry), thus there is typically a lag of a few weeks between the reduction of risk from the signals to the resulting cumulated positions in the portfolios. At present, the cumulated positions are in long Gamma territory, but less exposed than what latest signals would point to (refer 2nd chart).

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge