As expected the US Federal Reserve cut its policy interest rates by 25 basis points for the second successive meeting. The move reduced the Fed Funds target range to 1.75-2.00%. Three members voted against the decision. Two, as in July, wanted no change to the policy, while one wanted a larger cut of 50 basis points. The Committee maintained an easing bias, which suggests that further cuts are likely.

The Bank of England is scheduled for their monetary policy now, the British central bank is unlikely to announce a policy change today. With Brexit developments still the main driver of GBP, given ongoing uncertainties, the Monetary Policy Committee is likely to continue to sit on the sidelines. We expect a unanimous vote for an unchanged policy, with Bank Rate remaining at 0.75%. This is not one of the meetings when the Bank issues an Inflation Report or holds a press conference. However, the minutes of the meeting may provide some new insights.

We continue to maintain our bearish view on GBP. In tactical trades, recall that in early August we had rotated outright shorts into a limited loss cable put spread. The put spread admittedly has only three weeks left to expiry so the primary risk is that the structure expires before risks escalate once again in January. We will continue to monitor the developments in polls and restructure the trade as required in the coming weeks. Risk bias on GBP remains bearish with an inclination to re-enter outright shorts to fade the recent bounce in the coming weeks, the Supreme Court decision, valuations and elections polls depending.

EURGBP forecasts are left unchanged at 0.935 even for year-end. Assuming that elections are scheduled for late-November/ early-December, GBP will likely come under pressure in the run-up to this period particularly as election rhetoric picks up and polls stay unchanged.

Risk bias on GBP remains bearish. In various Brexit scenarios, we have conservatively put cable at 1.15 in a no-deal, but it could just as easily be another 10% lower (EURUSD is likely to be 3-5% weaker). Of the other scenarios, we see GBPUSD in the high 1.20s/very low 1.30s if the UK still manages to exit under the terms of the current WA. A general election could see GBPUSD under current levels (so sub-1.20 most likely) if the Tories are returned with a hard-Brexit mandate, or the 1.30 region if a Labour coalition is able to deliver a softish Brexit but with the offsetting risk of hard-left macro policies and the possibility of a second Scottish referendum. A second Brexit referendum would be a choice between the high teens on a second leave vote or 1.40 on a reversal to stay.

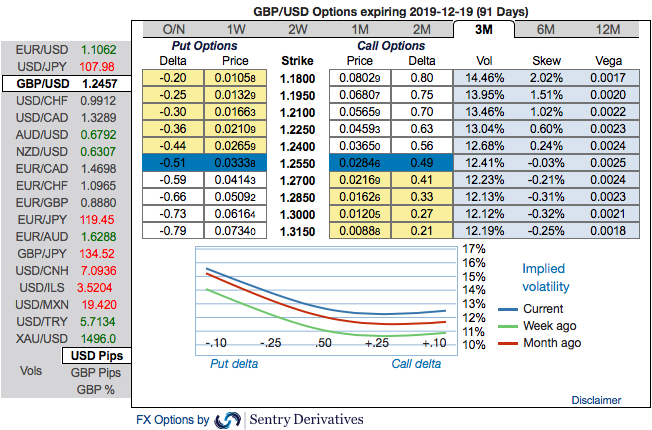

OTC outlook: The positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes that indicates the hedging sentiments for the downside risks amid the minor positive shift in RRs. To substantiate the downside risk sentiment, risk reversals have also been signaling bearish hedging sentiments. Some positive shift is observed in the bearish risk reversal numbers in the shorter tenors.

From the GBP OTC outlook, amid major downtrend we reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Stay short sterling via a limited loss tail hedge: Stay short a 2M/1M GBPUSD bear put spread (1.2592/1.1958). Courtesy: Sentrix, Saxo & Lloyds

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence