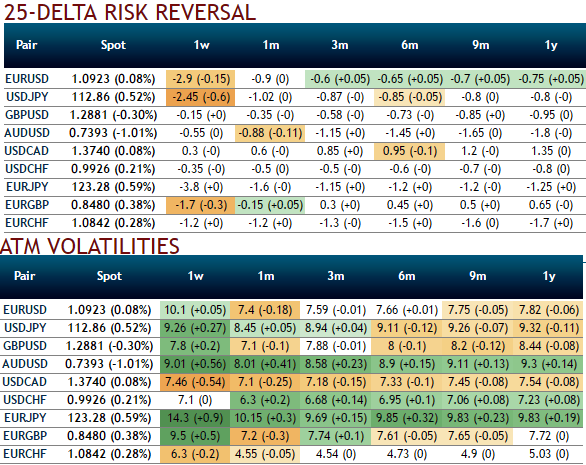

Please be advised that the 25-delta risk of reversal of GBPUSD has not been indicating any dramatic shoot up nor any slumps but bearish-neutral (no fresh change in risk reversals has been observed), but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

The risk reversal curve has been traveling in a linear direction, while spot curve is slumping downwards back to converge with the RR curve. While implied volatilities across all tenors have been shrunk massively.

Sterling fell pretty much with interest rate expectations after the vote to leave the EU in June. If we look at 3m futures contracts, there’s been a 60bp shift in relative pricing of where rates will be in a year’s time that reflects consensus now that fed funds will be at 1-1.25% in December 2017, while UK rates will be unchanged at 0.25%. This is in line with our forecasts and points to a period of relative calm for the pound (which is currently seeing some much-needed short-covering) before the economic implications of leaving the EU to become clearer.

We will fade the short covering: A period of calm, however, can turn into renewed weakness if the squeeze on real incomes undermines the recovery in economic confidence and upward revisions to growth forecasts. So while we expect GBPUSD to trade in between 1.3473 on northwards and 1.25 on southwards for next 6m or so, we are wary of spikes above 1.3473 in medium term perspective and expect to see a temporary return to 1.2650 at some point.

Brexit has hurt eventually no matter if it is going to be soft or hard exit: If we do see resilience for sterling through 2Q, as UK data hold up, and if we also see the euro trade down to parity with the dollar over that timescale, we would look to buy EURGBP for a sharp rebound in 2Q-3Q as UK growth suffers from higher inflation, and the political tailwinds facing the euro fade. A return to levels above EURGBP 0.88-89 seems to be pretty much possible in 2017.

Scandinavian currencies to fare better: GBP bears may also find that shorts in GBPSEK and GBPNOK bear fruit in rest of 2017 despite momentary spikes, as higher inflation globally would trigger a shift in the stance of monetary policy in Scandinavia.

While the cable volatility surface has returned to levels seen at the start of the year overall, but risk reversals and butterflies are now excessively cheap: - The sell-off in the cable skew is exaggerated compared to ATM volatility, since the risk remains asymmetric on the downside; - The tail risk is mispriced, as the GBPUSD butterfly is now less expensive than the EURUSD butterfly, which is unsustainable given the GBP extra tail risk.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different