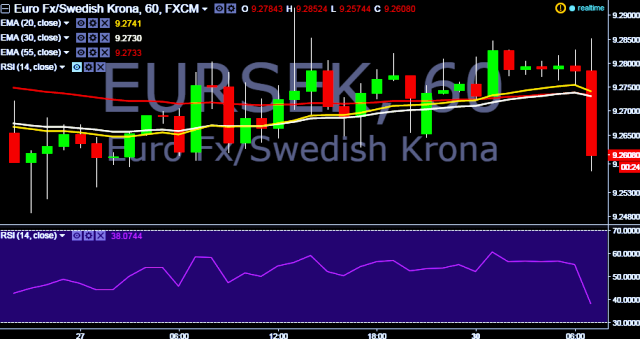

- EUR/SEK is currently trading around 9.2615 levels.

- It made intraday high at 9.2852 and low at 9.2574 levels.

- Intraday bias remains neutral till the time pair holds key support at 9.2488 marks.

- A current upward trend tests key resistances at 9.2953, 9.3028, 9.3262, 9.3781(May 19, 2016 high), 9.3967, 9.4102, 9.4682 (high of February 08, 2016) and 9.4942 marks.

- Alternatively, a daily close below 9.25 will take the parity down towards key supports at 9.2351 (May 25, 2016 low), 9.2050 (March 16, 2016), 9.1919 and 9.1416 marks respectively.

We prefer to take long position in EUR/SEK around 9.2625, stop loss 9.25 and target of 9.2953 marks.