The production has declined over the course of 2016, but natural gas inventory had reached a record high of 4 trillion cubic feet in the same year, thanks to previous two week winters, which depleted less stock. This year, the winter in the United States was quite chilling but not sufficient to draw down this record inventory significantly. Hence, we had to retrace back from our long call, though two of our targets were reached ($3.1 per MMBtu and $3.7 per MMBtu). We had suspected the gas price to reach as high as $5.2 per MMBtu. While we maintain our bullish outlook over the longer horizon, for now, we think that the price would retrace further from current $2.92 per MMBtu; at least towards $2.7 per MMBtu.

There is a strong possibility that gas price may decline to as low as $2 per MMBtu but that is not our base case at the moment.

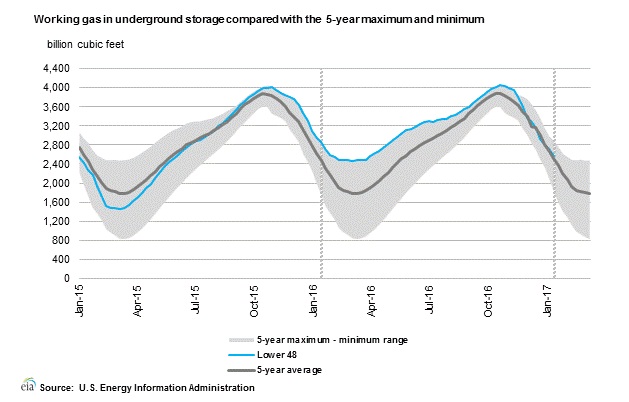

- According to latest numbers, working gas in the underground storage remains at 2.559 trillion cubic feet. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly draws in the inventory and that clearly shows that we are past the peaks, and from now on, the inventory draws are likely to be slowing down.

- Last week the inventory draw was 152 billion cubic feet and this week draw is expected at 124 billion cubic feet.

- EIA will release the inventory report at 15:30 GMT.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022