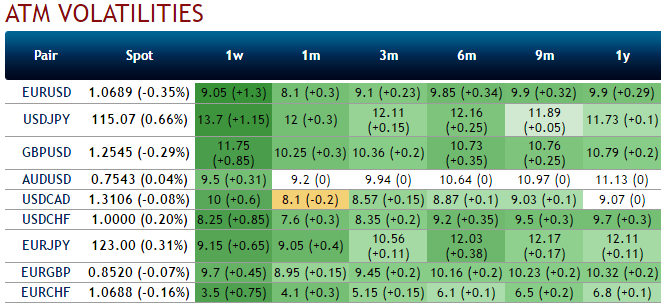

OTC and fundamental updates: Please be noted that the IVs are spiking of across various tenors, while delta risk reversals indicate a shift in hedging sentiments that shows offloading in heavy downside risks ahead of today’s BoJ monetary policy meet.

The Bank of Japan (BoJ) surprised the market Friday by increasing its buying in 5-10 year bonds, trying to keep the 10-year JGB yields near zero. This move comes after the central bank unexpectedly skipped widely anticipated bond-buying operations in shorter maturities, which and pushed JGB yields higher.

Markets now wait to watch the decision of the BoJ at its 2-day monetary policy meeting, that is scheduled to be held today, the central bank likely to stay pat as per the forecasts.

The advance US GDP for Q4 was on the weaker side of expectations although most of the miss was attributable to net exports - they subtracted a chunky 1.7ppts from growth.

The annualized change in the inflation-adjusted value of all goods and services produced by the economy has missed the forecasts to prints its fourth quarter number at 1.9% versus forecasts at 2.1% and previous 3.5%.

Even if the aggressive volatility investors wants to capture JPY should consider buying ATM instruments and/or being long of the smile convexity, against ATM volatility. But further USDJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would unlikely to rise significantly as the IVs do not seem to be favoring these distant strikes. We, therefore, recommend buying a 2m IV skews that signals both upside downside risks and shifted risk reversals, as a result, the below options strategy is advocated contemplating prevailing OTC buzz.

Hedging Recommendation:

Initiate longs in 2 lots of 2m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of the similar tenor, See that payoff function the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that as shown in the diagram the trader can still make money even if he was wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

When to use this strategy: Suppose any negative surprising news from today’s BoJ monetary policy news that could revolve USDJPY and you want to take your odds on downside risks – you can trade a strip.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady