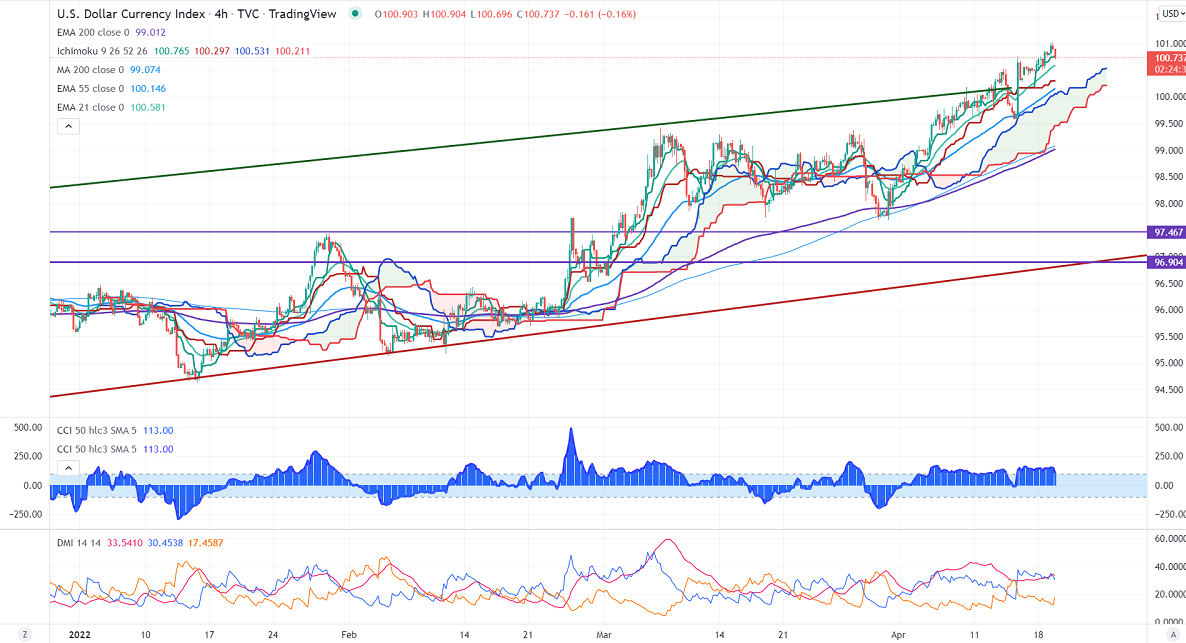

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 100.74

Kijun-Sen- 100.29

DXY trades higher for a third consecutive week and hits the highest level since Apr 2020. The hawkish stance by Fed officials pushed the US dollar further higher. According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in May increased to 91.05% from 84.9% a week ago. It hits a high of 101.02 and is currently trading around 100.71.

Economic events today

US building permits and housing starts

Technically, near-term support is at 100.48, and any break below targets 100/99.50.Major trend continuation only below 99.50.

On the higher side, immediate resistance stands around 101.20 and an indicative break above will take the index to 103.

It is good to buy on dips around 100.20-25 with SL around 99.50 for the TP of 103.