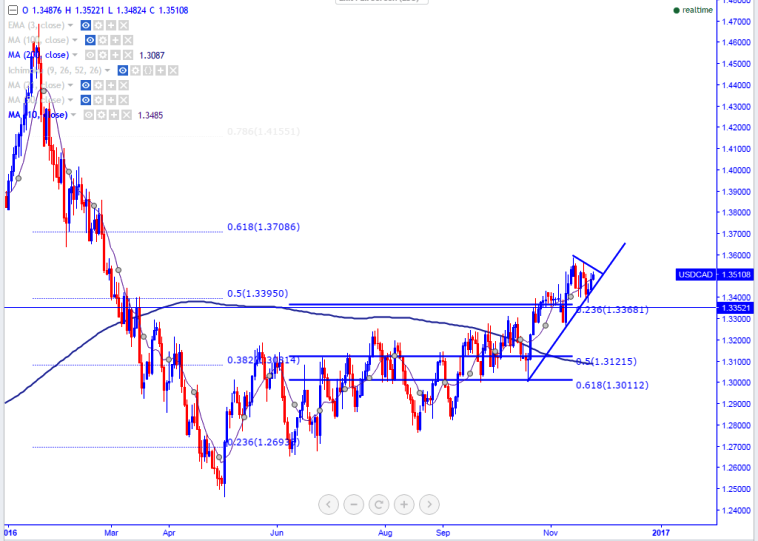

- Major resistance – 1.3545 (trend line joining 1.35885 and 1.35642)

- Major support – 1.3368 (23.6% retracement of 1.26544 and 1.35885)

- Loonie formed a temporary bottom around 1.33780 after jumping till 1.35885. The pair recovered sharply from the low of 1.3378 till 1.35220 at the time of writing. It is currently trading around 1.35070.

- On the lower side, immediate support is around 1.3480 (10- day MA) and any break below will drag the pair down till 1.3420/1.3368. Any close below 1.3400 confirms minor trend reversal .

- The trend line joining 1.35885 and 1.35642 (1.3545) will be acting as near term resistance and any violation above will take the pair to temporary top formed at 1.3590/1.3660/1.3718 (161.8% retracement of 1.35885 and 1.3378).

It is good to buy on dips around 1.35000 with SL around 1.3430 for the TP of 1.3590/1.3718

Resistance R1-1.3545

R2-1.3600

R3- 1.3718

Support

S1-1.3480

S2-1.3435

S3- 1.3365