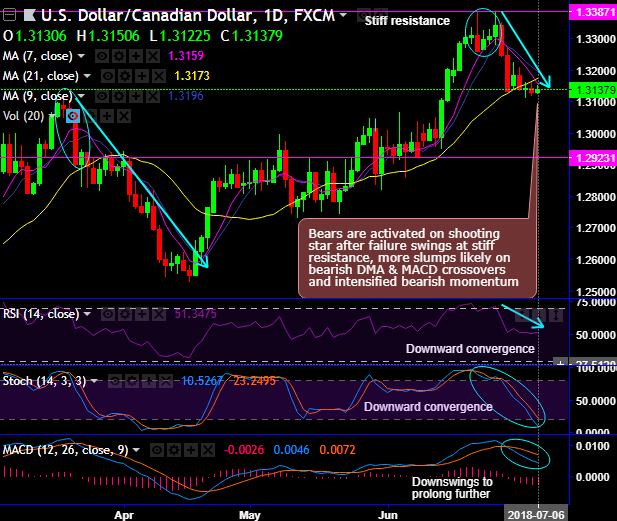

- USDCAD has shown a considerable pullback after hitting highs of 1.3386 on account of escalating the US and other economies trade war.

- Technically, the bears of this pair are activated after failure swings at stiff resistance of 1.3386 levels and the formation shooting star pattern at the same juncture that has been plummeted prices below DMAs, consequently, more slumps likely on bearish DMA & MACD crossovers and intensified bearish momentum (refer RSI & stochastic curves’ downward convergence on daily chart).

While the intermediate trend also seems edgy as you could make out failure swings at channel resistance, the occurrence of back-to-back shooting star signal weakness (weekly chart), the momentum oscillators on this timeframe also indicate overbought pressures. On the lower side, near-term support is around 1.3050-1.2920 levels. But for now, near-term resistance is at around 1.3173 levels and one can expect upswings only upon any convincing break-out above these levels, else, we could foresee more slumps upto 1.2920 levels on buzzing bearish momentum.

- We’ve got the series of data announcements scheduled for today, unemployment rate, trade balance and Ivey PMIs are lined up from the Canadian side.

While the Non-farm employment change and unemployment rate from US side, the US economic data today are expected to reaffirm a strong labour market. However, wage growth is arguably still the more important factor the market will be focused on.

- While WTI Crude oil prices have shown a huge recovery from the low of $64.49 to the recent highs of $75.24 levels after recent OPEC meeting and EIA inventory inspections. OPEC has announced that output is set to increase by 1MMbbls/d. It hits high of $71.45 and is currently trading around $72.28 levels.

- Trade tips: At spot reference: 1.3138 levels, it is wise to snap rallies and attain exponential yields via tunnel spreads using upper strikes at 1.3160 and lower strikes at around 1.3070 levels.

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -44 levels (which is bearish), while hourly USD spot index was at -92 (bearish) while articulating at (10:49 GMT). For more details on the index, please refer below weblink: