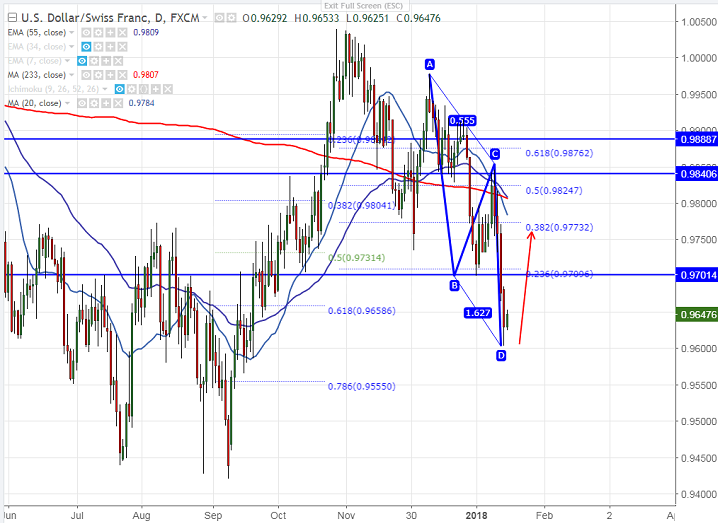

- Harmonic pattern –Bullish AB= CD pattern.

- USD/CHF has declined sharply till 0.96030 and shown a minor jump from that level. The pair declined almost 250 pips from the temporary top at 0.9845. It has recovered till 0.96533 and is currently trading around 0.96466.

- Minor trend of the pair is bullish as long as support 0.9600 holds. The near term resistance is around 0.9705 and any break above will take the pair to next level till 0.9740 (10- day MA)/0.9800 (20-day MA). Short term bullishness will be above 0.9845.

- On the lower side, major support is around 0.9600 and any break below targets 0.9550/0.9500. Overall bullish invalidation only below 0.9420.

It is good to buy on dips around 0.9630-35 with SL around 0.9600 for the TP of 0.9705/0.9740.