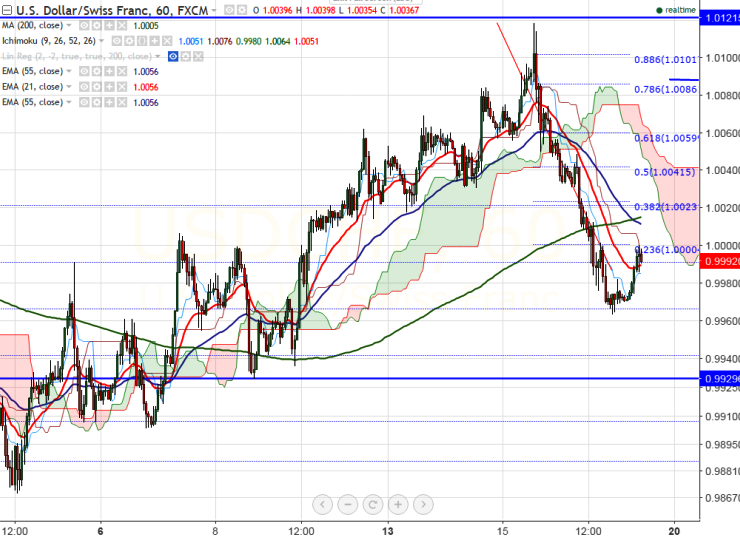

- Major resistance -1.0014 (200- H MA)

- Major support – 0.99297 (Feb 8th 2017 low)

- USD/CHF declined sharply from the minor top of 1.01187 on Feb 15th 2017 and declined sharply from that level. It is currently trading around 0.99960.

- Short term outlook of the pair is still bullish as long as support 0.99297 holds.

- The declined from 1.03436 has got completed at 0.98600. So further bearishness only below 0.98600.

- On the higher side, above 1.01180 will take the pair till 1.0342 in the short term. The major intraday resistance stands at 1.0015 (200- H MA) and any break above will take the pair till 1.00450/1.0070.

- Any violation below 0.99297 will drag the pair down till 0.98600.

It is good to buy on dips around 0.9975 with SL around 0.99290 for the TP of 1.0045/1.0070

Resistance

R1-1.0015

R2 -1.00450

R3- 1.0700

Support

S1-0.99290

S2-0.9900

S3- 0.9860