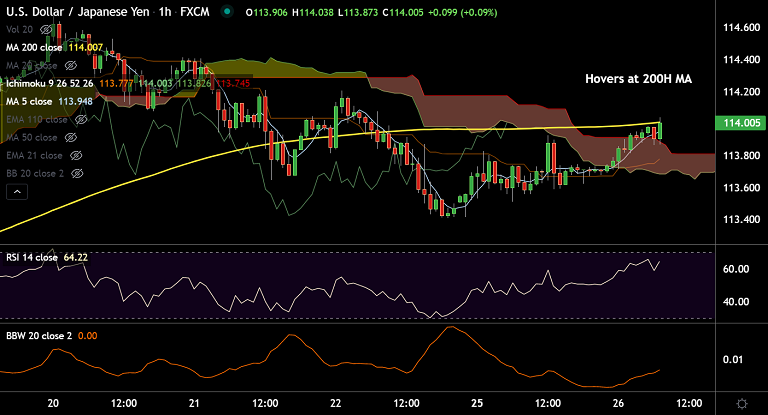

USD/JPY chart - Trading View

USD/JPY was trading 0.19% higher on the day at 113.92 at around 06:45 GMT, outlook is neutral.

The major hovers around 200H MA, decisive break above will see upside continuation.

Stiff resistance aligns at 114.30 (falling trendline), price action contained below from the past three weeks.

US inflation expectations jump to 15-year high after Federal Reserve (Fed) Chair Jerome Powell's speech on Friday.

Data Watch:

| Time (GMT) | Event | Forecast |

Previous |

| 1255 | US Redbook Index (YoY) | - | 15.4% |

| 1300 | US Housing Price Index (MoM)(Aug) | 1.3% | 1.4% |

| 1300 | US S&P/Case-Shiller Home Price Indices (YoY)(Aug) | 20.1% | 19.9% |

| 1400 | US Richmond Fed Manufacturing Index(Oct) | 3 | -3 |

| 1400 | US New Home Sales (MoM)(Sep) | 0.755M | 0.740M |

| 1400 | US CB Consumer Confidence(Oct) | 108.3 | 109.3 |

| 1400 | US New Home Sales Change (MoM) (Sep) | - | 1.5% |

| 2030 | US API Weekly Crude Oil Stock | - | 3.294M |

Major Support Levels:

S1: 113.41 (Previous week's low)

S2: 112.97 (5-week DMA)

S3: 112.90 (21-EMA)

Major Resistance Levels:

R1: 114 (200H MA)

R2: 114.30 (Trendline)

R3: 114.69 (yearly high)

Summary: USD/JPY has resumed upside after a brief pause in the previous week. Retest of yearly highs at 114.69 likely.