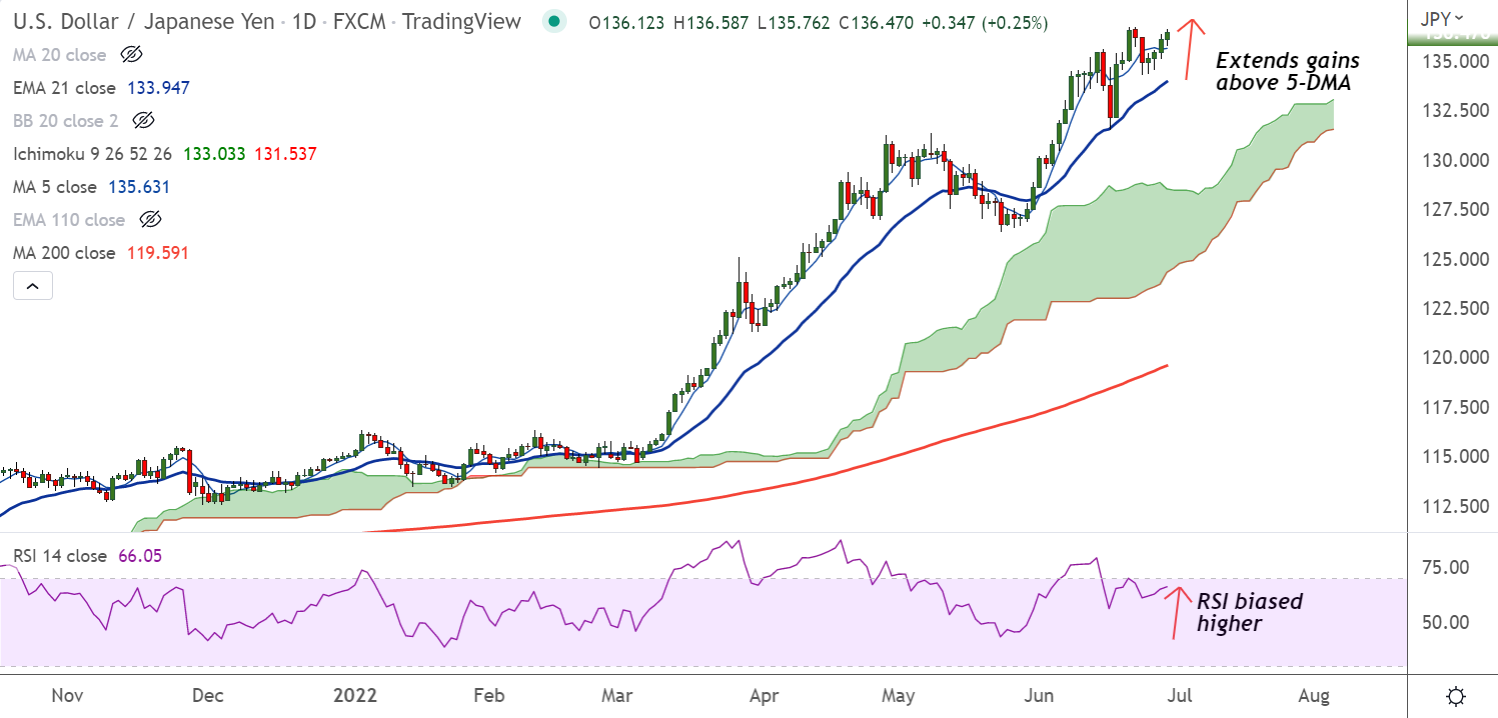

Chart - Courtesy Trading View

USD/JPY was trading 0.30% higher on the day at 136.53 at around 11:00 GMT.

The major grinds higher for the fourth straight session, more upside on cards.

GMMA shows major and minor trend are bullish, MACD and ADX support upside in the pair.

Price action is above daily and weekly cloud, Chikou span is biased higher.

Recession fears dampened investors’ sentiment, driving flows away from the risk-sensitive aussie.

Hawkish comments by New York Fed President John Williams and San Francisco’s Mary Daly, lifted bets for aggressive Fed rate hikes, supporting the dollar.

Investors preferred to remain on the sidelines ahead of Fed Chair Jerome Powell's speech at the ECB forum in Sintra.

Powell's comments would be watched for clues about the Fed's policy outlook, which would provide a fresh impetus to the pair.

Data Watch:

- US Core Personal Consumption Expenditure (PCE) for Q1 2022, is expected to remain unchanged at 5.1%

- US Q1 GDP, is likely to confirm a 1.5% annualized contraction

Major Support and Resistance Levels:

Support levels:

S1: 135.61 (5-DMA)

S2: 133.94 (21-EMA)

Resistance levels:

R1: 137

R2: 137.90 (Upper BB)

Summary: USD/JPY trades with a bullish bias. The pair is poised to refresh yearly highs above 136.71. Weakness only below 21-EMA.