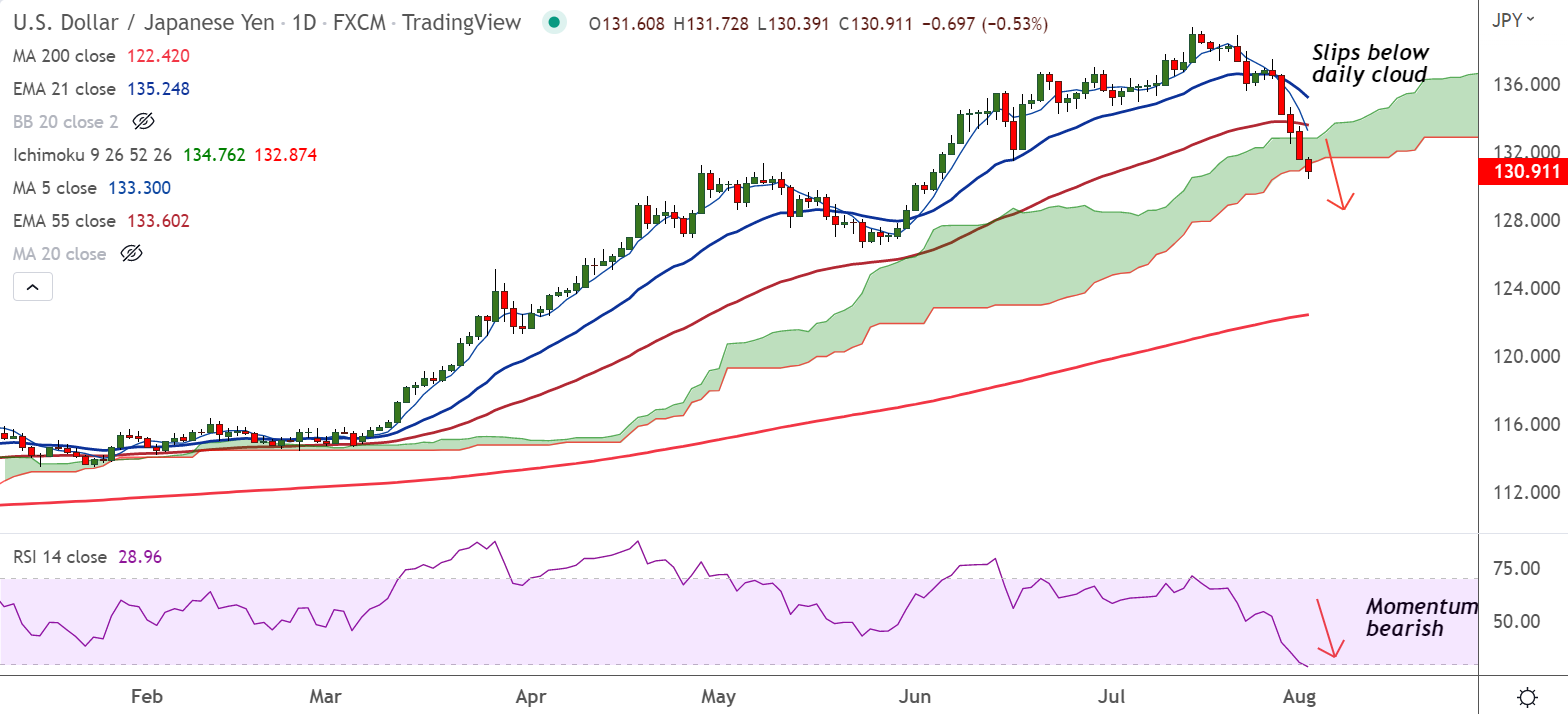

Chart - Courtesy Trading View

Technical Analysis:

- USD/JPY was trading 0.56% lower 130.86 at around 10:05 GMT

- The major is extending weakness for the fifth straight session

- Price action has slipped below daily cloud, raising scope for further downside

- MACD and ADX support downside in the pair, Chikou span is biased lower

- Momentum is bearish, volatility is high and rising

- GMMA indicator shows minor trend is bearish, while major trend is turning bearish

Support levels:

S1: 129.58 (110-EMA)

S2: 126.36 (May 2022 low)

Resistance levels:

R1: 131.28 (Cloud base)

R2: 132.82 (Cloud top)

Summary: USD/JPY recovery lacks traction, the pair is poised for further downside.