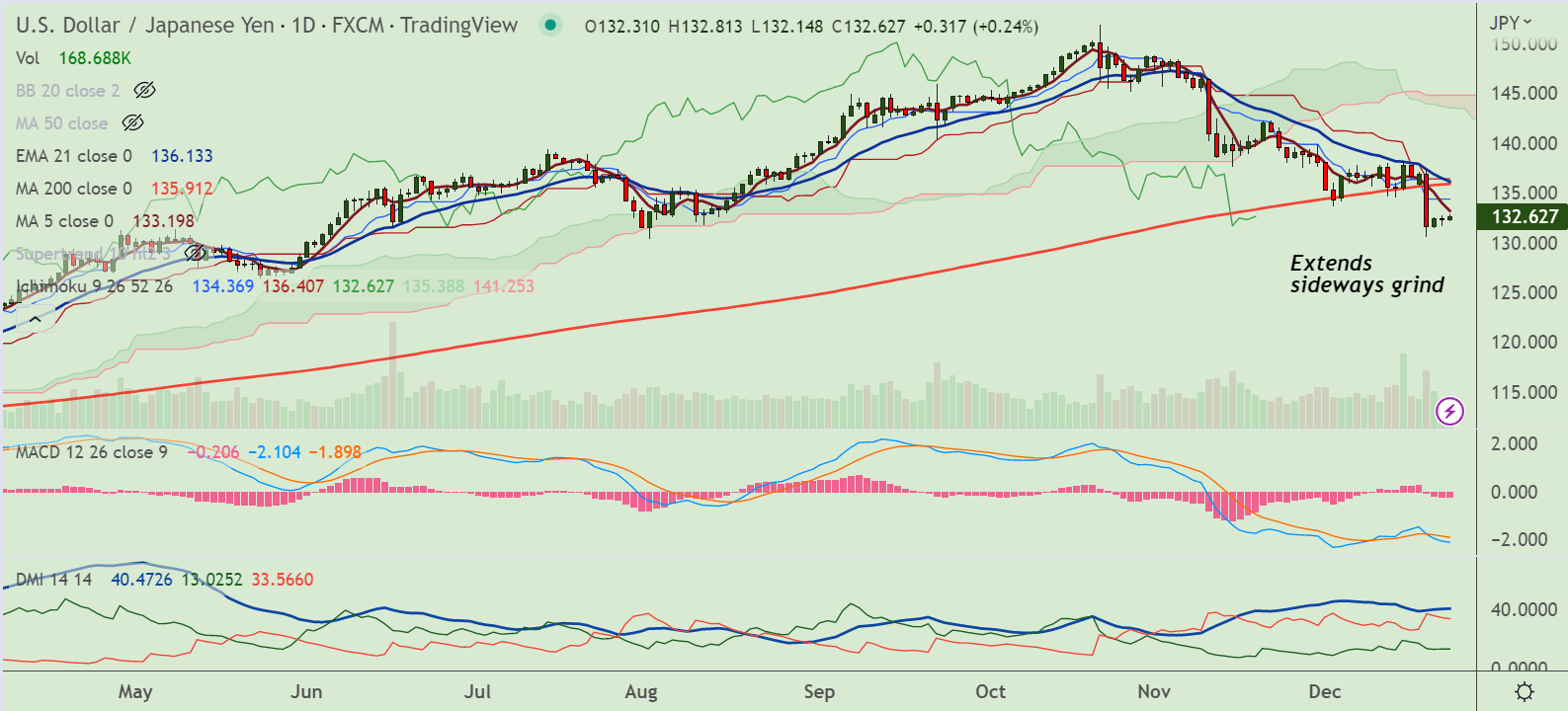

Chart - Courtesy Trading View

- USD/JPY was trading 0.24% higher on the day at 132.62 at around 09:55 GMT

- The pair is extending sideways for the 3rd consecutive session, bias is neutral

- Price action has slipped below 200-DMA, and is well below the daily cloud

- Improvement in risk tone weighs on the dollar, though hawkish Fed expectations help limit losses

- Upbeat US data released on Thursday pointed to a still-tight labour market and resilient economy

- Focus going forward remains on release of the US Personal Consumption Expenditure (PCE) data

- Core PCE Price Index will provide fresh cues on inflation and influence the Fed's rate-hike path

- Japanese Finance Minister Shunichi Suzuki said on Friday that he doesn't see any changes to the BoJ's policy

Major Support Levels: 131.72 (55-week MA), 126.54 (21-EMA)

Major Resistance Levels: 133.20 (5-DMA), 134.70 (200H MA)

Summary: USD/JPY grinds sideways for the third consecutive session. Bias is still bearish, bearish invalidation only above 200-DMA.