- USD/JPY extends retreat from 3-month highs at 110.03, 'Bearish Cypher' formation on daily charts keeps scope for further downside.

- Yen remains bid, tracking decline in the S&P 500 futures and 10-year treasury yield.

- Fed disappointed with a less hawkish than expected statement which weakened the USD across the board.

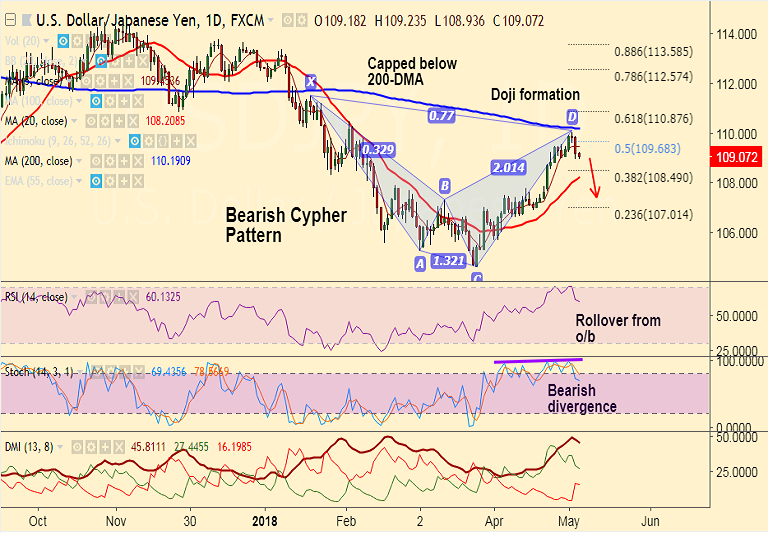

- The pair has formed a 'Bearish Cypher' pattern which adds to bearish bias. We also evidence a Doji formation at highs.

- Price has closed below 5-DMA and now finds next major support at 100-DMA at 108.70.

- Technical indicators are also biased lower. 'Bearish Divergence' on stochs adds to downside bias. Violation at 100-DMA will accentuate weakness.

- Markets gear up for another US Non-Farm Payrolls Friday. Break above 110.00 likely if the wage growth number, due at 18:30 GMT, betters estimates.

Support levels - 108.70 (100-DMA), 108.20 (20-DMA), 108.49 (38.2% Fib)

Resistance levels - 109.45 (5-DMA), 110, 110.19 (200-DMA), 110.87 (61.8% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-USD-JPY-edges-lower-from-3-month-highs-USD-dumped-as-FOMC-less-hawkish-than-expected-1289651) is approaching final targets.

Recommendation: Book partial profits at low. Bias lower, stay short.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.