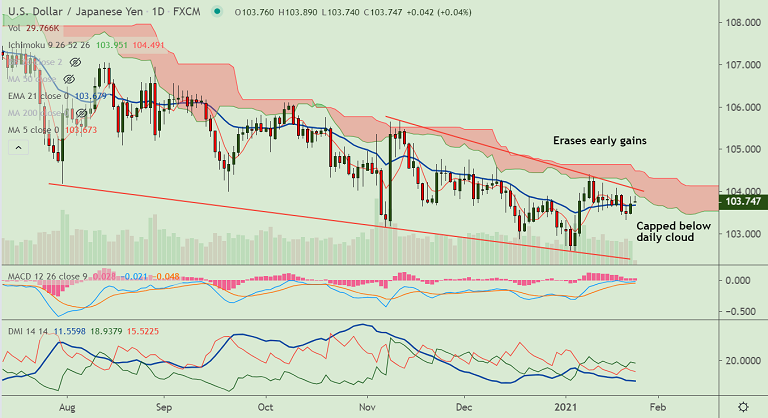

USD/JPY chart - Trading View

USD/JPY erased early gains and was trading largely unchanged at 103.76 at around 04:00 GMT, down from session highs at 103.89.

The pair struggles for direction as concerns gyrated around US President Biden’s second stimulus package and new virus worries.

Joe Biden’s proposed $1.9 trillion stimulus package faces opposition within his own party. Further, UK PM Boris Johnson expressed concern that the new coronavirus could be 30% more deadly than the original one.

Technical bias for the pair remains bearish. Consecutive doji formation on the weekly candle suggests indecisiveness to drive prices higher.

Cloud offers stiff resistance on the upside and any significant up move only on decisive break above.

Supports on the downside align at 103.67 (21-EMA), 103.58 (20-DMA), 103.32 (Jan 21 low), 102.45 (trendline).