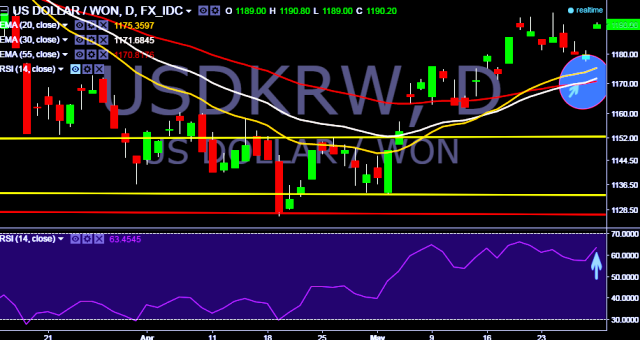

- USD/KRW is currently trading around 1190 levels.

- It made intraday high at 1190 and low at 1189 levels.

- Intraday bias remains neutral for the moment.

- A daily close above 1194 is required to drag the parity higher towards key resistances at 1195, 1201, 1209 (20D EMA) and 1220 (March 03, 2016 high) marks respectively.

- Alternatively, a sustained close below 1182 will tests key supports at 1172, 1162, 1153 (November 2015 low) /1142 (20D EMA)/ 1134/1127 (October 2015 low) /1121/1115 levels respectively.

- Daily chart showing the 20D EMA has crossed over 30D and 55D EMA, which signals bullish trend. In addition, a sustained close above 1194(high as on May 24, 2016) is also required to confirm the same.

- Today South Korea released Manufacturing BSI index with positive numbers at 72 m/m vs 69 m/m previous release.

We prefer to take long position in USD/KRW only above 1194, stop loss 1177 and target 1209 marks.