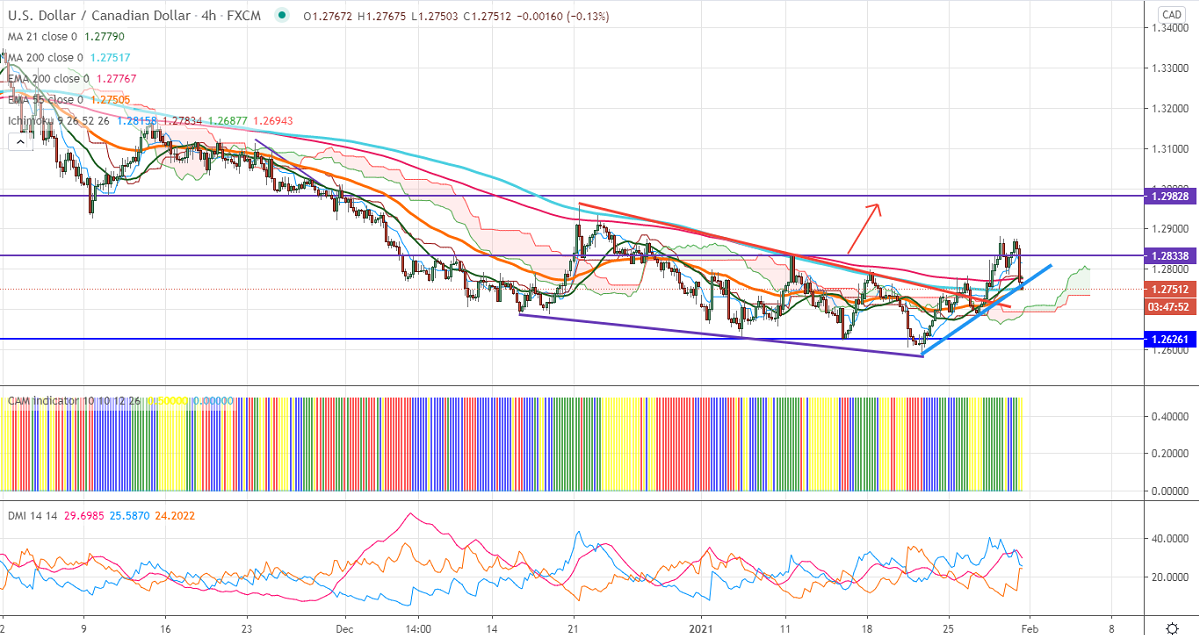

Ichimoku analysis (4-Hour Chart)

Tenken-Sen- 1.28176

Kijun-Sen- 1.27834

USDCAD has declined more than 100 pips from a high of 1.2870 on strong Canada GDP. The Canadian economy came at 0.7% in November compared to a forecast of 0.4%. The economy is in expansion mode for the past seven months. DXY's next leg of bullishness will start if it breaks 91 levels. USDCAD hits an intraday high of 1.28609 and currently trading around 1.28393.

WTI crude oil is consolidating in a narrow range between $53.90 and $51.46 for the past two weeks. The overall trend is bullish as long as support $51.50 holds.

Technically, the pair faces near term resistance at 1.2800. Any indicative break above will take till 1.28650/1.2900/1.2965. The near term support is around 1.2750; an indicative violation below will take to the 1.2680/1.2600.

It is good to sell on rallies around 1.27825-85 with SL around 1.2850 for a TP of 1.2680.