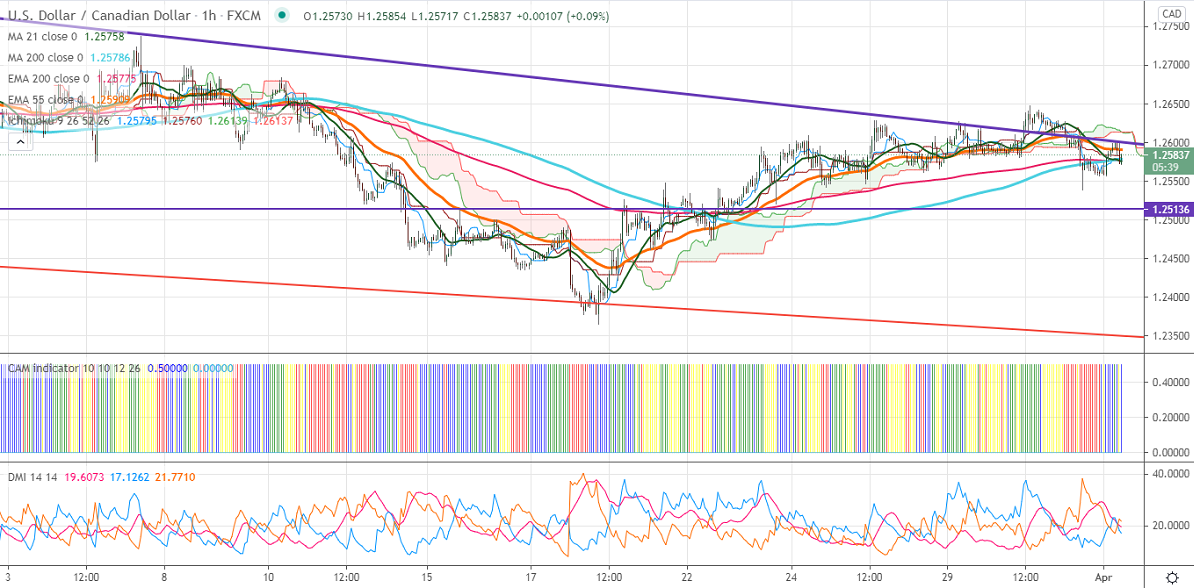

Ichimoku analysis (1-Hour Chart)

Tenken-Sen- 1.25795

Kijun-Sen- 1.25830

USDCAD is trading in a narrow range between 1.26474 and 1.25392 in two days. The pair is slightly on the lower side despite the strong US dollar. It was one of the best performers in the past two weeks and jumped more than 250 pips on a surge in US bond yield. The US 10-year yield has cooled off slightly after hitting a high of 1.77%. DXY continues to trade higher and any break above 93.50 confirms a bullish continuation. A jump to 93.690 likely. Canada's real GDP rose by 0.7% in Jan 2021 compared to a forecast of 0.5%.

WTI crude oil gained by $1.5 ahead of OPEC meeting on production cuts. The fresh lockdown in France and the extension of lockdown in Germany are dragging the oil price. The short-term trend is bearish as long as resistance $62 holds.

Technically, the pair faces near-term resistance at 1.26050. Any indicative break above will take till 1.2660/1.2700/1.2745. The significant support is around 1.2530; an indicative violation below will take to the 1.2500/1.2460.

Indicator (Hourly chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to buy on dips around 1.25300 with SL around 1.2500 for a TP of 1.2660.