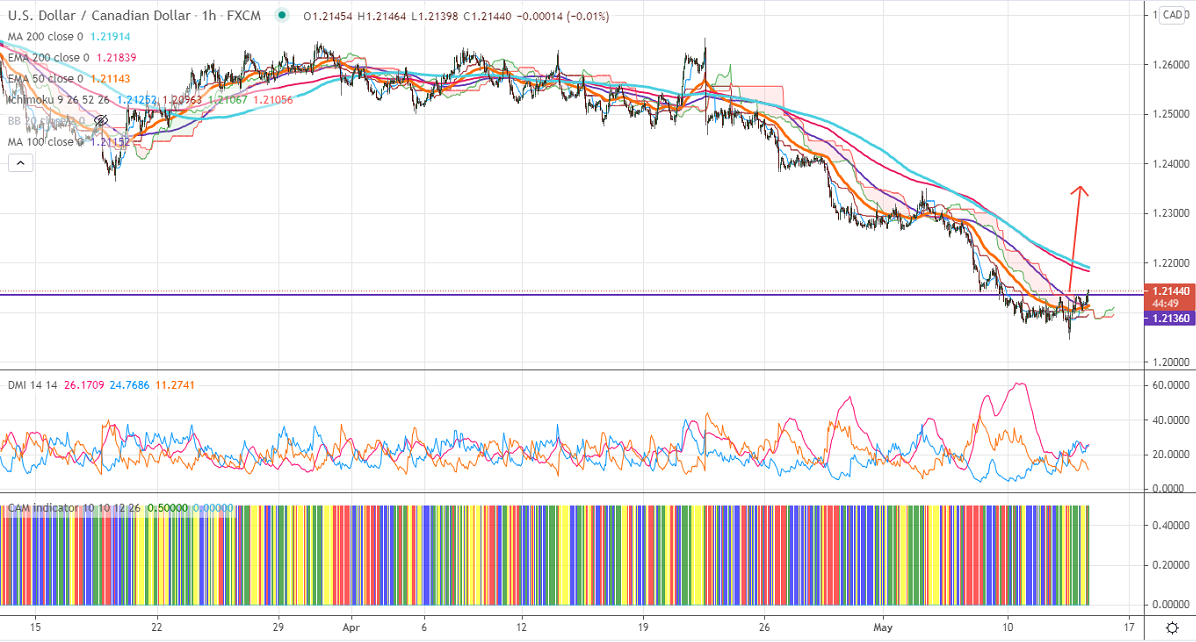

Ichimoku analysis (1-Hour Chart)

Tenken-Sen- 1.21251

Kijun-Sen- 1.20961

USDCAD has recovered more than 100 pips from a low of 1.20461 on broad-based US dollar selling. The pair was one of the worst performers in the past four months and lost more than 6.5%. The surge in commodities such as Copper and Iron ore is supporting commodity currencies such as the Australian and Canadian dollar. DXY surged yesterday after upbeat US CPI data. . The US inflation rose by 0.8% in Apr much better than the forecast of 0.2%. The annual inflation surged to 4.2% in Apr from 2.6% in Mar, the highest level in 13 years. The US 10-year yield surged more than 6% from yesterday's bottom 1.609%. USDCAD hits an intraday high of 1.24164 and is currently trading around 1.21400.

WTI crude oil declined slightly after hitting 8- week high. The decline in the number of corona cases and vaccine optimism has increased the demand for crude oil. The short-term trend is bullish as long as support $62.30 holds.

Technically, the pair faces near-term resistance at 1.2150. Any indicative break above will take till 1.21850/1.2200/1.2280. Major trend continuation only above 1.2660. The significant support is around 1.20450. Any violation below will take to the 1.2000/1.19450.

Indicator (1-hour chart)

CAM indicator – Bullish

D4irectional movement index –Bullish

It is good to buy on dips around 1.2128-30 with SL around 1.2090 for a TP of 1.2270.