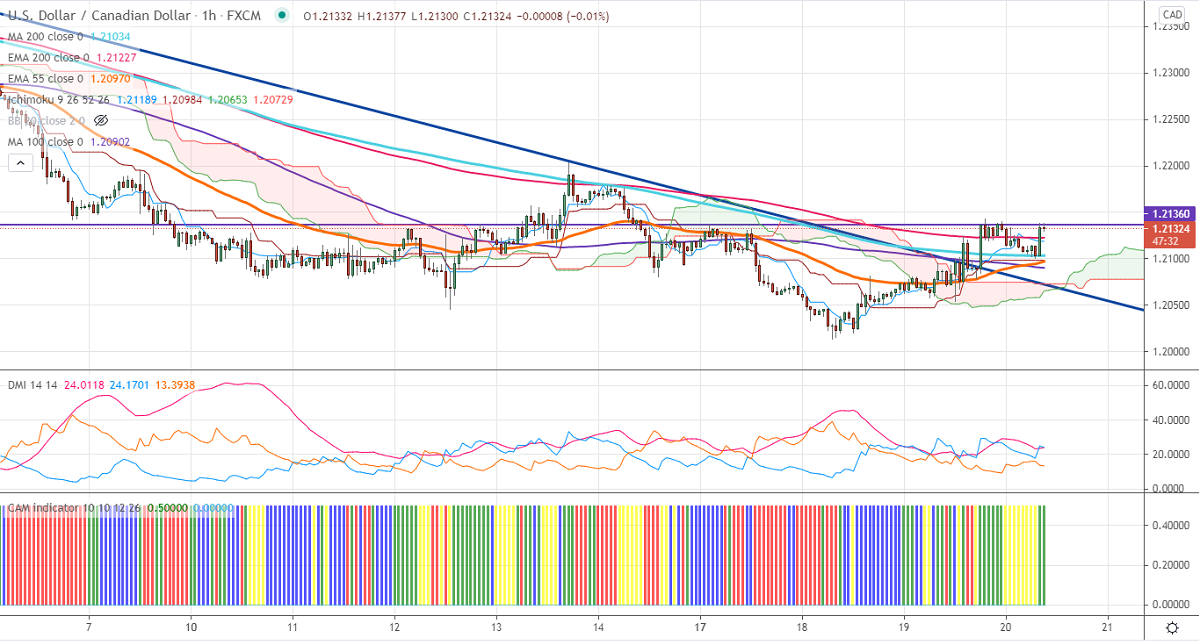

Ichimoku analysis (1-Hour Chart)

Tenken-Sen- 1.21189

Kijun-Sen- 1.20984

USDCAD has recovered more than 100 pips from a low of 1.20130 on broad-based US dollar selling. The pair was one of the worst performers in the past six months and lost more than 9.5%. The surge in commodities such as Copper and Iron ore has increased demand for commodity currencies such as Canadian and Australian dollar. The Canadian Annual inflation came at a 3.4% vs2.2% increase in Mar, the highest level in a decade. USDCAD hits an intraday high of 1.21377 and is currently trading around 1.21348.

WTI crude oil declined sharply on the increasing number of coronavirus cases in India. The short-term trend is bearish as long as resistance $68 holds.

Technically, the pair faces near-term resistance at 1.2150. Any indicative break above will take till 1.21850/1.2200/1.2280. Major trend continuation only above 1.2660. The significant support is around 1.21000. Any violation below will take to the next level to 1.2045/1.2000.

Indicator (1-hour chart)

CAM indicator – Bullish

D4irectional movement index –Bullish

It is good to buy on dips around 1.2100 with SL around 1.2045 for a TP of 1.2270