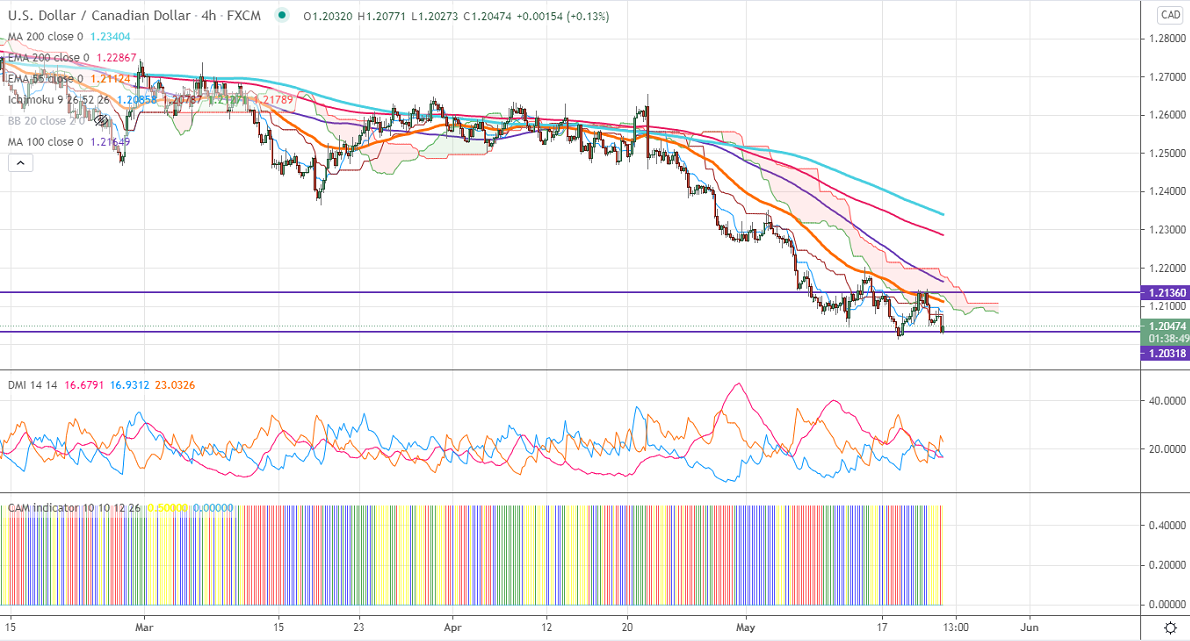

Ichimoku analysis (4-Hour Chart)

Tenken-Sen- 1.20867

Kijun-Sen- 1.20787

USDCAD has recovered more than 45 pips on despite strong Canadian retail sales. It came at 3.6% in Mar compared to a forecast of 2.3%. The pair hits 3 -1/2 years low around 1.20129 on board–based US dollar selling. It is currently trading around 1.20659. The upbeat US flash manufacturing index also supporting the pair at lower levels. The manufacturing PMI jumped to 61.5 in Apr vs an estimate of 60. The services PMI hits record high 70 points in May well above forecast 64.3. USDCAD hits an intraday high of 1.20771 and is currently trading around 1.20546.

WTI crude oil jumped more than $1.5 from a low of $61.54 on decreasing number of corona cases. The short-term trend is bearish as long as resistance $68 holds.

Technically, the pair faces near-term resistance at 1.2080. Any indicative break above will take till 1.2150/1.21850/1.2200/1.2280. Major trend continuation only above 1.2660. The significant support is around 1.2000. Any violation below will take to the next level to 1.1970/1.1950.

Indicator (4-hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to sell on rallies around 1.2088-90 with SL around 1.2150 for a TP of 1.1970.