FxWirePro- USDCAD Daily Outlook

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.25306

Kijun-Sen- 1.24465

Previous week low- 1.22878

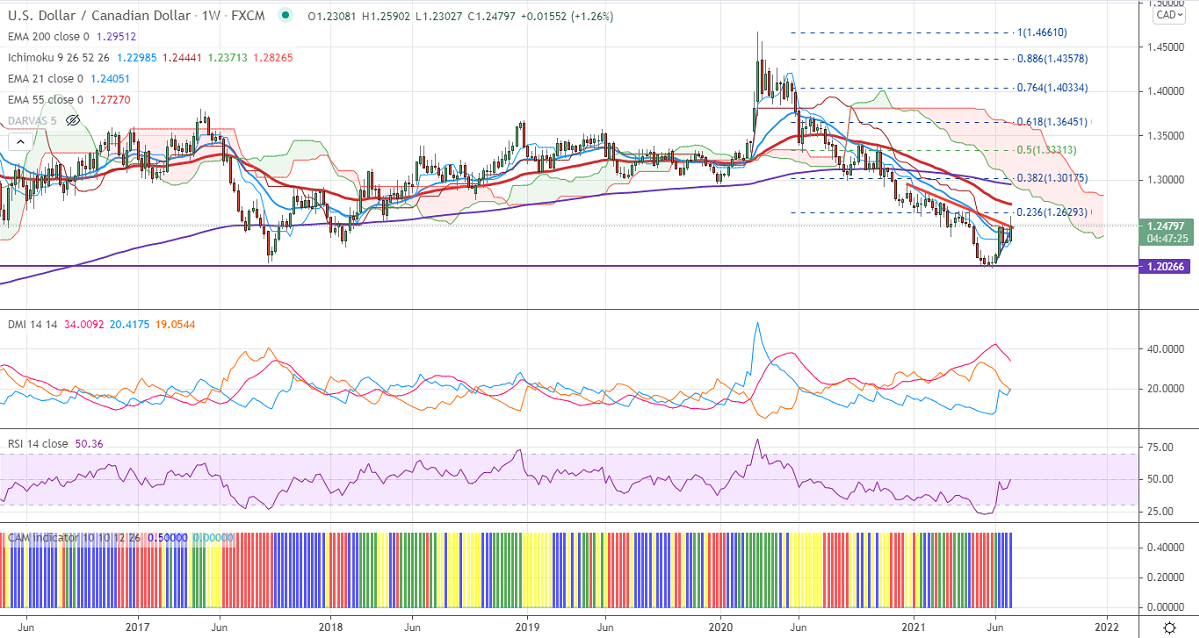

The pair is trading lower despite strong Canadian employment data. The Canadian economy has added 230700 jobs in June compared to a forecast of 172500, while the unemployment rate came steadily by 7.8% vs an estimate of 7.8%. WTI crude oil has taken support near 200-4H MA and rose more than 5.5%. Short term trend is bearish as long as resistance $77 holds.

Trend –Bullish

The near-term resistance is around 1.2600, a breach above targets 1.2630/1.2660/1.2700. On the lower side, immediate support stands around 1.24580; violation below will take the pair down to the next level 1.2430/1.2360.

It is good to buy on dip around 1.2435 with SL around 1.2370 for TP of 1.2660.