Intraday bias - Bearish

USDCAD declined after upbeat Canadian jobs data. It has added 108.3K jobs in October vs. the Forecast of 11K. While the unemployment rate dropped to 5.2%, slightly below the estimate of .5.2%.The jump in the US unemployment rate also puts pressure on the pair at a higher level. It hits a low of 1.34686 and is currently trading around 1.35045.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec increased 61.5% from 48.2% a week ago.

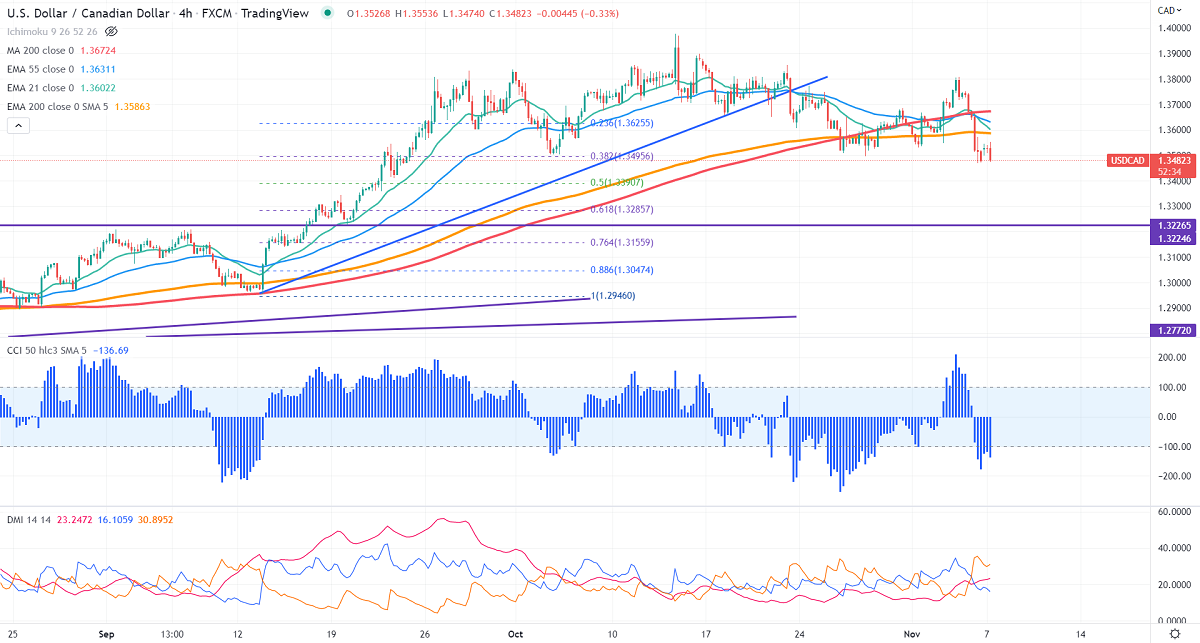

Technically in the 4-Hour chart, the pair is holding below the short-term( 21- EMA), 55 EMA, and long-term moving average of 1.36334 (200- EMA). Any violation below 1.3460 confirms further bearishness. A dip to 1.3400/1.3345 is possible.

WTI crude oil spiked more than 5% on supply concerns and the easing of an aggressive rate hike. Any daily close above $91.70 will push oil prices higher to $98.

The near-term resistance support is around 1.3550 and any breach above targets is 1.1.3600/1.3500.

Indicators (4-Hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to sell on rallies around 1.3528-30 with SL around 1.3570 for a TP of 1.3350.