Intraday bias - Neutral

USDCAD recovered slightly after mixed US CPI data. CPI for Jan came at 6.4% YOY, above the estimate of 6.2%. It has declined for the seventh consecutive month after peaking at 9.1% in Jun 2022. Markets eye US retail sales data for further direction. It hits a high of 1.3385 and is currently trading around 1.33824.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb declined to 87.8% from 90.8% a day ago.

The US 10-year yield recovered sharply after mixed US CPI data. Any close above 3.75% targets $3.95%. The US 10 and 2-year spread widened to -86 basis points from -76% bpbs.

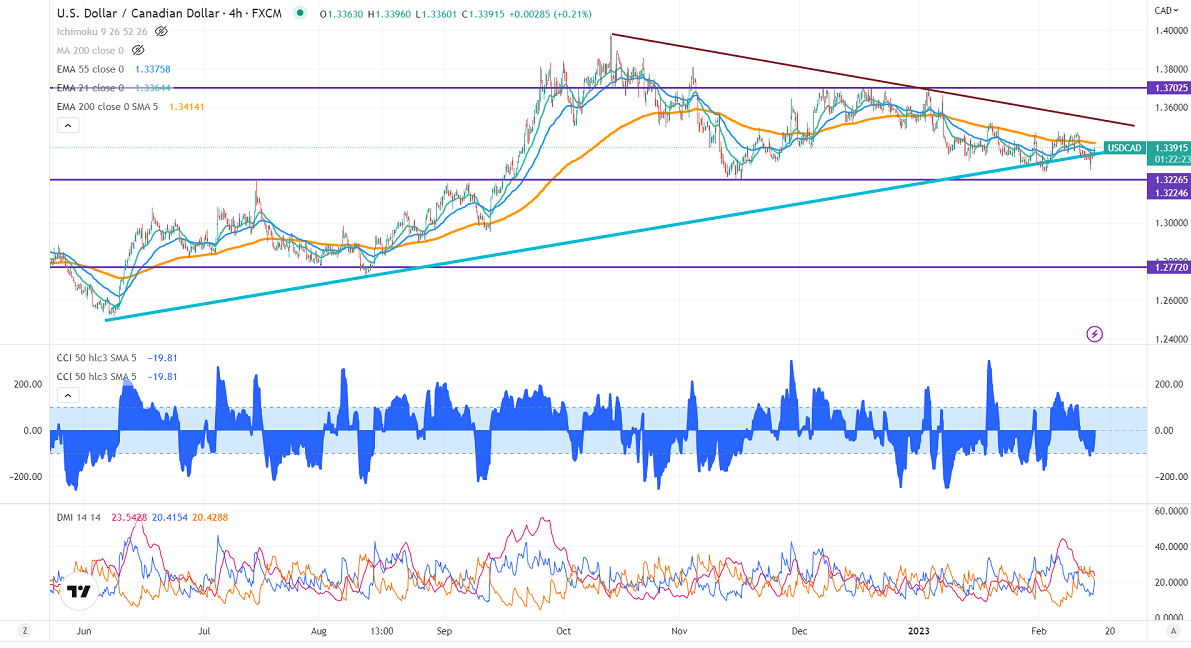

Technically in the 4-Hour chart, the pair is holding below the short-term( 21- EMA), 55 EMA, and the long-term moving average of 1.34233 (200- EMA). Any violation below 1.3300 confirms further bearishness. A dip to 1.3260/1.3220 is possible.

WTI crude oil declined slightly after mixed US CPI data. Any daily close above $80 will push oil prices up to $85.

The near-term resistance is around 1.3400 and any breach above targets is 1.3435/1.3470/1.3520.

Indicators (4-Hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to buy on dips around 1.3350 with SL around 1.3300 for a TP of 1.3525.