Significant Resistance - 1.2920

USDCAD pared some of its gains after hitting a multi-month high. Hawkish Fed rate hike and surge in US treasury yields support the US dollar at lower levels. According to the Fed watch tool, the probability for a 50 bpbs rate hike in June has increased to 90% from 83.6% a week ago. USDCAD hits an intraday high of 1.28825 and currently trading around 1.28711.

ISM manufacturing index came at 55 .4 in Apr, below the estimate of 57.6.

Technical:

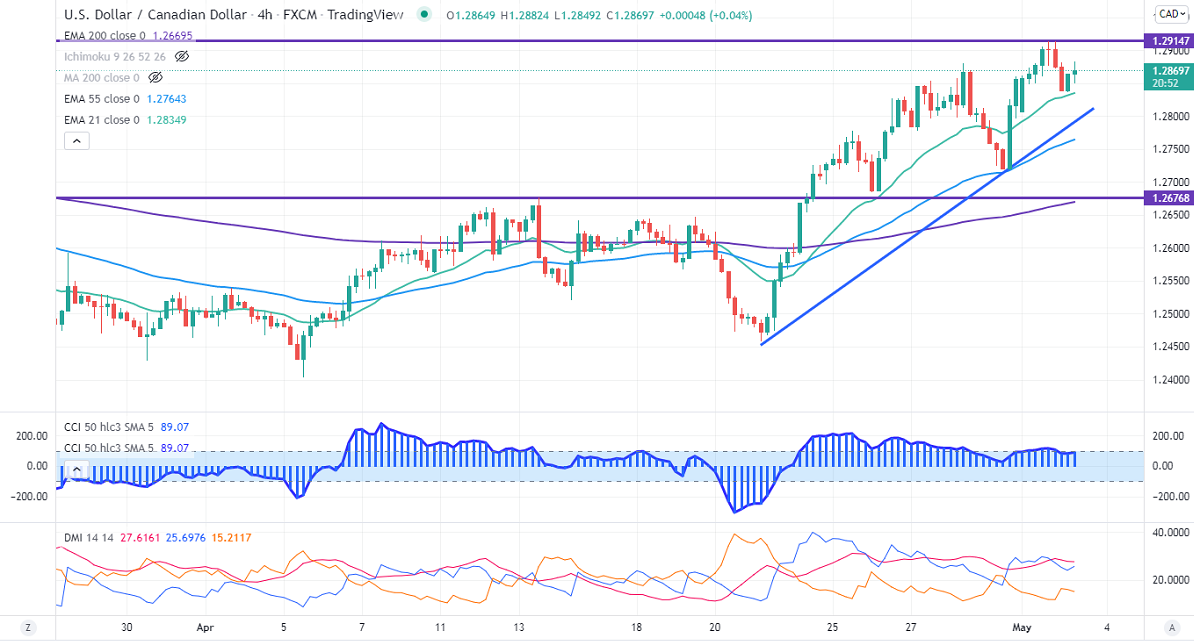

USDCAD is holding above short-term (21 EMA), medium-term (55 EMA), and long-term ( 200 MA) in the daily chart.

ADX- Neutral

CCI (50) above zero line in the daily chart.

Resistance to be watched- 1.2950, 1.3000, and 1.3050.

Support- 1.27800, 1.2700, and 1.2660.

It is good to buy on dips around 1.2800 with SL around 1.2750 for a TP of 1.2950.