FxWirePro: USDCHF Daily Outlook

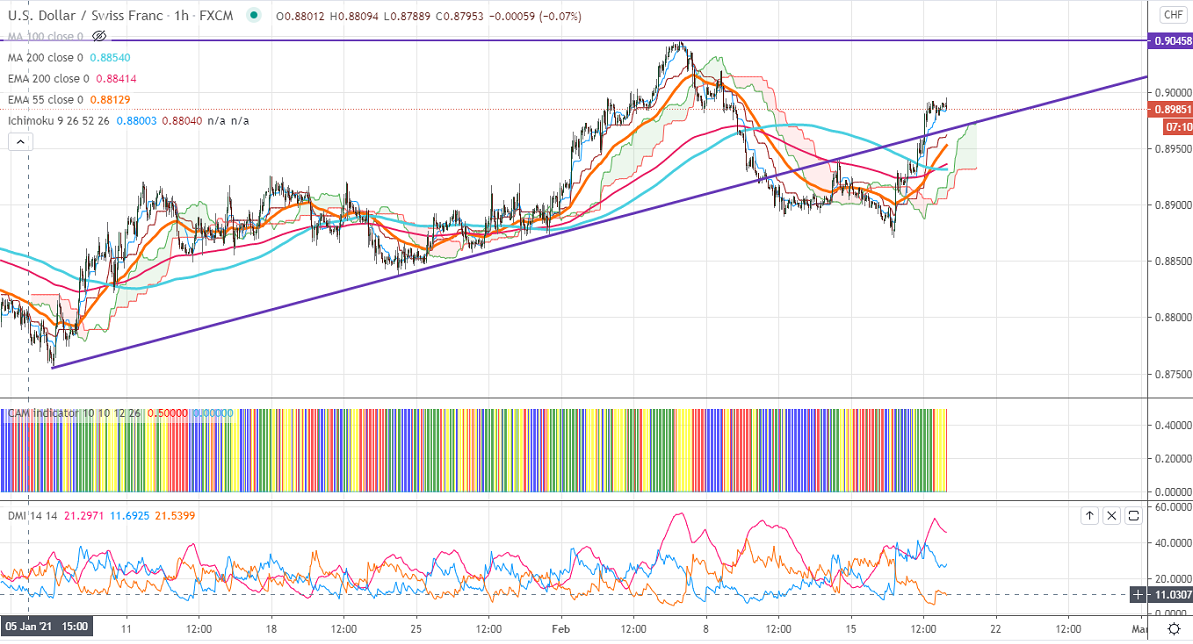

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.89833

Kijun-Sen- 0.89601

USDCHF is trading higher and holding well above 0.8950 levels on broad-based US dollar buying. The jump in US 10- year yield and upbeat US retail sales is supporting the US dollar index at lower levels. It rose 5.3% in Jan m/m, the highest jump in the seventh months. The data came much better than the estimate of 1.1%. Markets eye US initial jobless claims and Philly fed manufacturing for further direction.

The near-term resistance at 0.9000; any convincing violation above will take to the next level till 0.9045. Significant trend reversal only above 0.90450. A jump till 0.910/0.9150 likely.

On the lower side, significant support stands at 0.8890, any indicative break below targets 0.88380/0.8800/0.8750.

Indicator (1-hour chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 0.8965 with SL around 0.8920 for a TP of 0.9040.