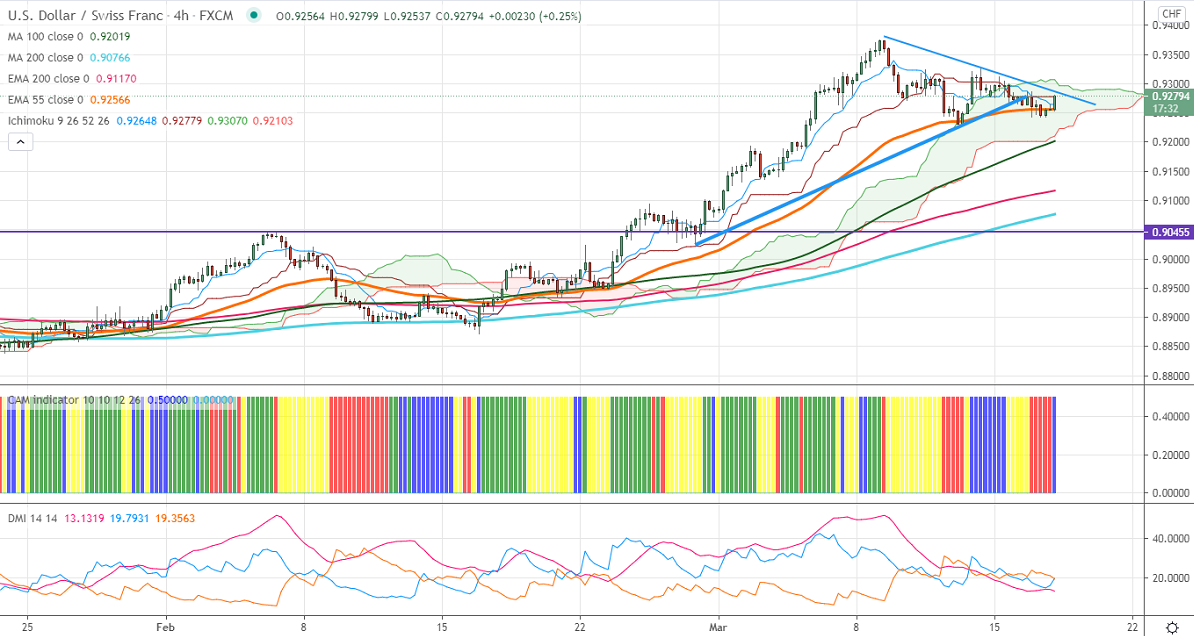

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.92648

Kijun-Sen- 0.92779

USDCHF is trading flat for the past ten days and the intraday trend stays neutral. The pair's significant weakness can be seen only if it breaks below 0.9230. The broad-based US dollar buying and surge in US bond yield is supporting the pair at lower levels. US retail sales dropped by 3% in Feb compared to a forecast of -0.5. The January data was revised to 7.6% from 5.3% as previously reported. Markets eye US FOMC meeting for further direction. The pair hits an intraday low of 0.92738 and is currently trading around 0.92728.

The pair is facing significant resistance at 0.93250, this confirms intraday bullishness. A jump till 0.9380/0.9435/0.94715 (161.8% fib). On the lower side, significant support stands at 0.9230, any indicative break below targets 0.9180/0.9150/0.9100.

Ichimoku Analysis- The pair is trading below Kijun-Sen and cloud. But it should close below 0.92250 for bearish continuation.

Indicator (4-hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell below 0.9230 with SL around 0.9270 for a TP of 0.9150.