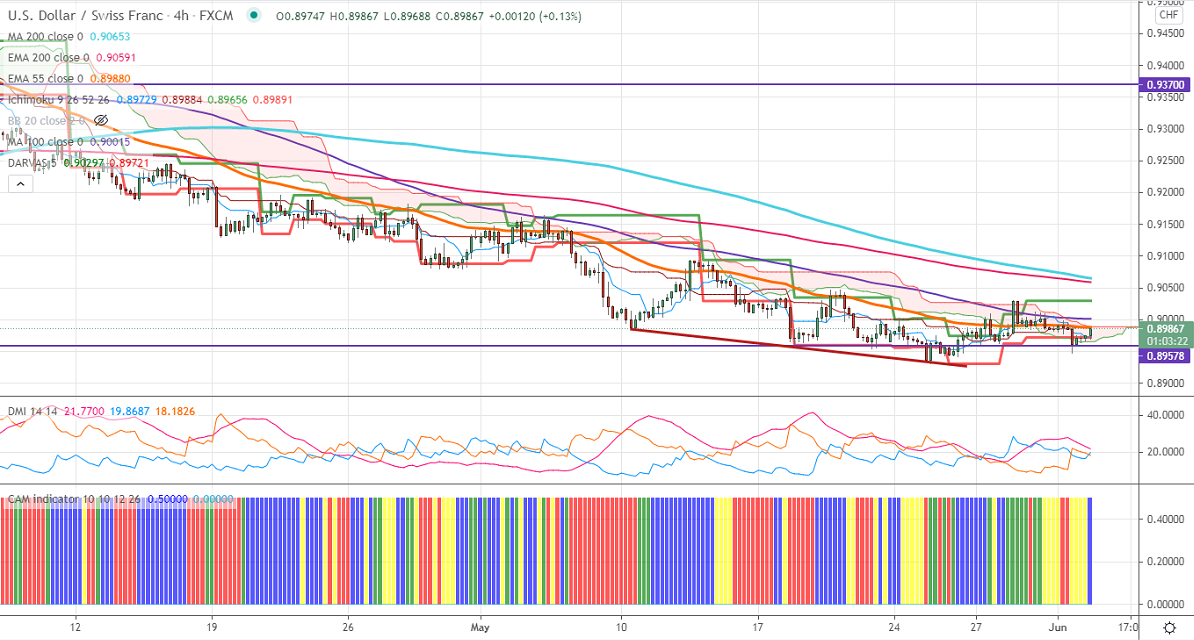

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.89729

Kijun-Sen- 0.89884

USDCHF is trading flat for the past four days. The pair is struggling to close above 0.9000 levels. Any major trend continuation only if it breaks 0.9030. The US ISM manufacturing index rose to 61.2 in May compared to a forecast of 60. The construction spending rose 0.2% less than expected in Apr after surging 1% in Mar. The US dollar index recovered sharply from a low of 89.66. Any breach above 90.50 confirms a bullish continuation. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding above 4- Hour Tenken-Sen, and below kijun-Sen, cloud. The near-term support is around 0.89450. Any indicative break below will take the pair to next level to 0.8920/0.8900/0.8870/0.8835. On the higher side, near-term resistance is around 0.9030. Any breach above targets 0.9045/0.9075/0.9095/0.9150.

Indicator (4-Hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to buy above 0.9030 with SL around 0.8990 for a TP of 0.9100.