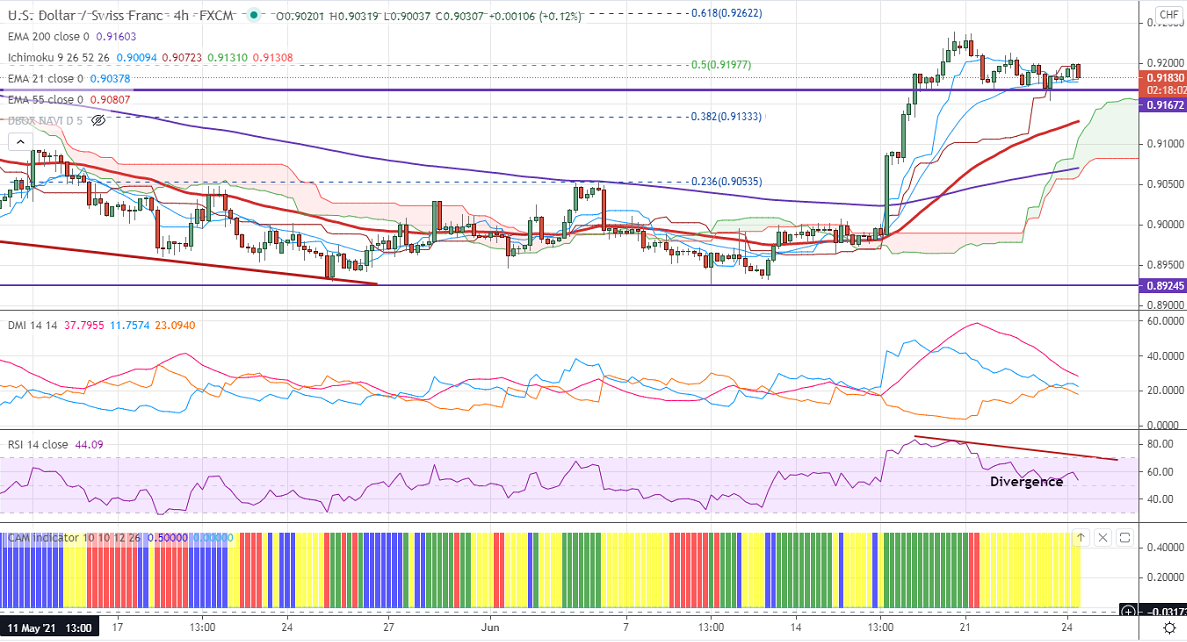

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.91909

Kijun-Sen- 0.91571

USDCHF has shown a minor decline after two weeks of the uptrend. The pair surged after a hawkish surprise from fed on June 16th has moved their first rate hike from 2024 to 2023. The speech from Powell yesterday shows that surge in inflation transitory and no chance of a rate hike in the near term. The US dollar index is trading below 92 levels, any violation below 91.40 confirms further bearishness. The US 10-year bond yield surged more than 10% from a minor low of 1.354%. The pair hits an intraday low of 0.91794 and is currently trading around 0.91827.

Short term outlook:

In the 4-hour chart, RSI has formed bearish divergence. So minor decline till 0.9120 not ruled out.

Trend- Bullish

The pair is holding below 4-hour Tenken-Sen, and above the cloud, Kijun-Sen. The near-term resistance is around 0.92370. Any indicative break above 0.92620 confirms that decline from 0.9470 got over at 0.89340. A jump till 0.9300/0.9360 is possible. On the lower side, near-term support is around 0.9150. Any convincing breach below targets 0.9120/0.9080. Significant selling will happen only if it breaks 0.8920.

Indicator (4-Hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to sell on rallies around 0.91825-50 with SL around 0.9237 for a TP of 0.9060.