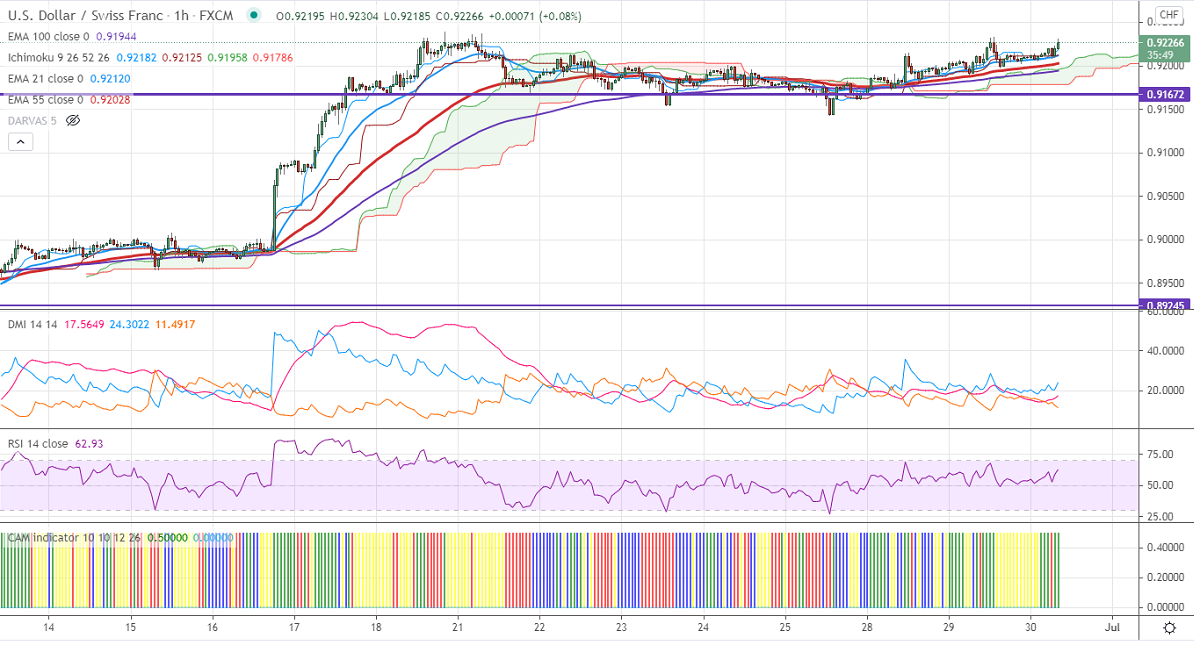

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 0.92146

Kijun-Sen- 0.92114

USDCHF continues to trade higher and holding above 0.9200. The US dollar recovered on surge due to inflation and hawkish FOMC meeting. The US dollar index is trading above 92 levels; any breach above 92.50 confirms further bullishness. The US 10-year bond yield declined slightly and trading below 1.50%. The pair hits an intraday low of 0.92237 and is currently trading around 0.92238.

Trend- Bullish

The pair is holding above 4-hour Tenken-Sen, and above the cloud, Kijun-Sen. The near-term resistance is around 0.92370. Any indicative break above confirms a bullish continuation. A jump till 0.9300/0.9360 is possible. On the lower side, near-term support is around 0.91980. Any convincing breach below targets 0.91630/0.9140. Significant selling will happen only if it breaks 0.8920.

Indicator (1-Hour chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.92000 with SL around 0.9160 for a TP of 0.9300.