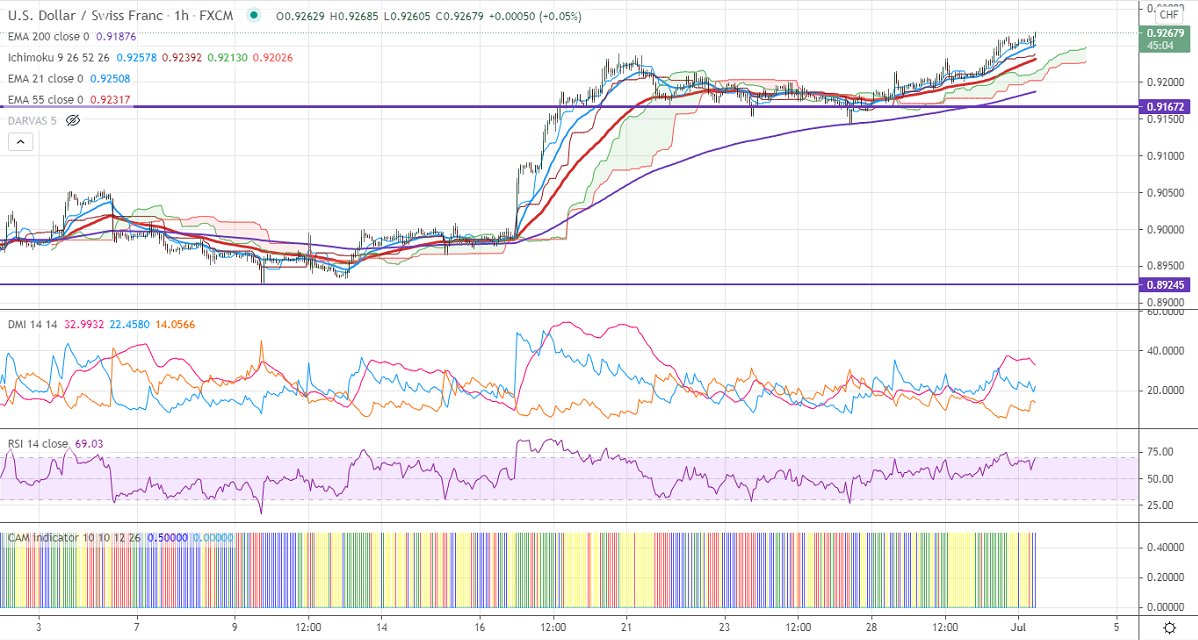

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.92554

Kijun-Sen- 0.92360

Previous week low – 0.91424

Major resistance – 0.92604 (161.8% fib)

The pair broke 0.92604 yesterday and holding above that level on board-based US dollar buying. The upbeat US ADP employment and a minor pullback in US bond yield are supporting the US dollar. DXY hits 2- week high, any breach above 92.50 confirms bullish continuation. Markets eye US ISM manufacturing and jobless claims data for further direction.

Trend- Bullish

USDCHF to reach 0.9300/0.9360 as long as support 0.9180 holds. On the lower side, near-term support is around 0.9230. Any convincing breach below targets 0.9200/0.9180/0.9140. Significant selling will happen if it breaks 0.8920.

Indicator (1-Hour chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.92480-50 with SL around 0.92000 for a TP of 0.9360.