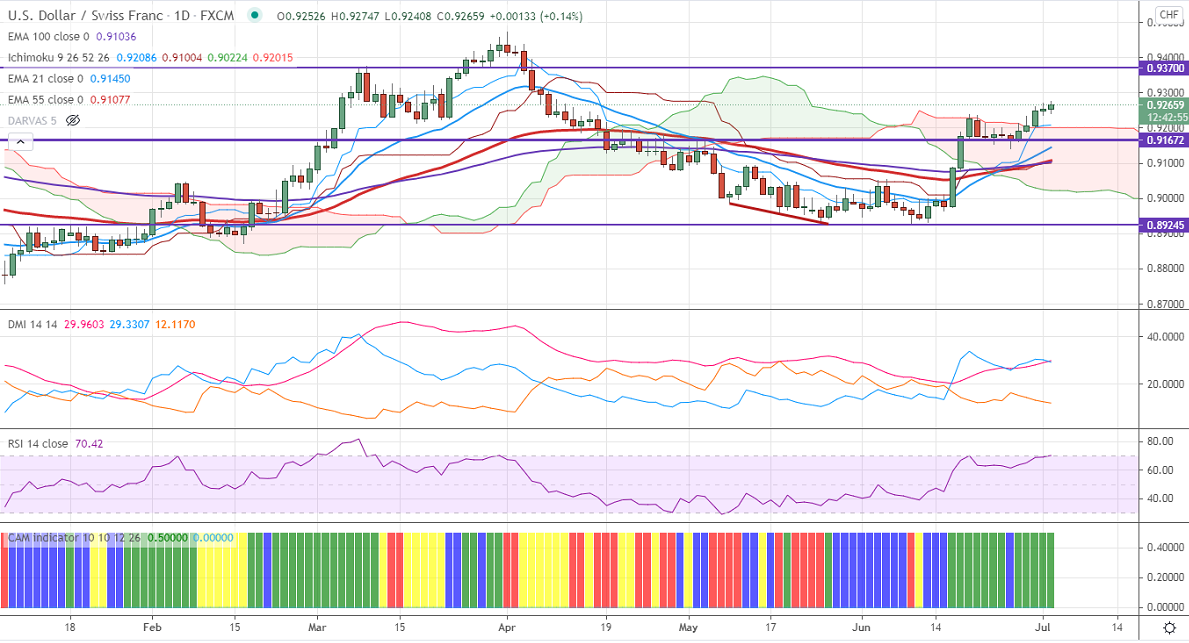

Ichimoku analysis (Daily chart)

Tenken-Sen- 0.92070

Kijun-Sen- 0.920980

Previous week low – 0.91424

Yesterday's high- 0.927147

The pair is trading higher and made higher high daily on board-based US dollar buying. The upbeat economic data and hawkish US Fed is pushing dollar prices higher. US ISM manufacturing came at 60.6% slightly below expectations of 61. The number of people who have filed for jobless benefits declined to 364K compared to a forecast of 388K. DXY breaks yesterday's high and hovering around that level. Markets eye US Non-Farm-payroll data for further direction.

Trend- Bullish

The near=term resistance is at 0.92750, breach above will take the pair to 0.9300/0.9360. On the lower side, near-term support is around 0.9230. Any convincing breach below targets 0.9200/0.9180/0.9140. Significant selling will happen if it breaks 0.8920.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.92480-50 with SL around 0.92000 for a TP of 0.9360.