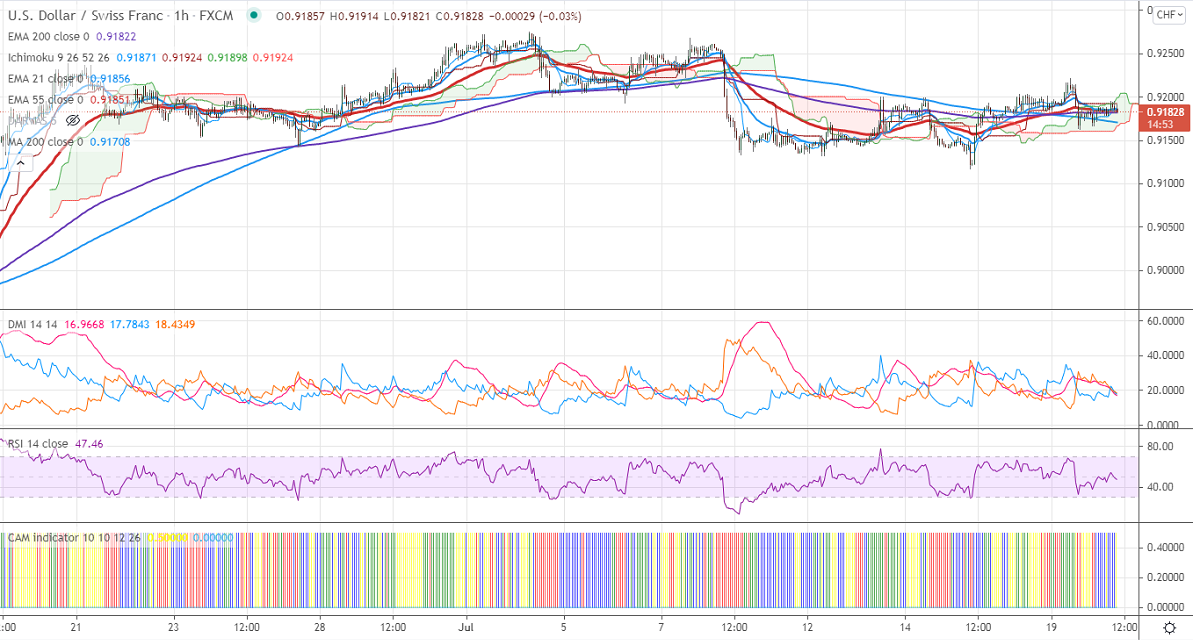

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.91871

Kijun-Sen- 0.91671

Previous week High– 0.91924

Previous week low- 0.91330

The pair has declined after a minor pullback above 0.9200 level. The intraday trend is neutral as long as resistance 0.92750 is intact. The surge in the number of delta corona variants has increased the demand for safe-haven assets like the Swiss franc and yen. The US 10-year yield hits 1.179%, the lowest level in five months as delta corona spread might dampen the economy. USDCHF hovering around 0.9154.

Trend- Neutral

The near-term support is around 0.9150, the breach below will take the pair to 0.9120/0.9059/0.9000. On the higher side, immediate resistance is around 0.9230. Any convincing breach above targets 0.92750.

Indicator (4 Hour chart)

CAM indicator – Slightly Bullish

Directional movement index –Neutral

It is good to buy on dips around 0.9170 with SL around 0.9130 for a TP of 0.9270.