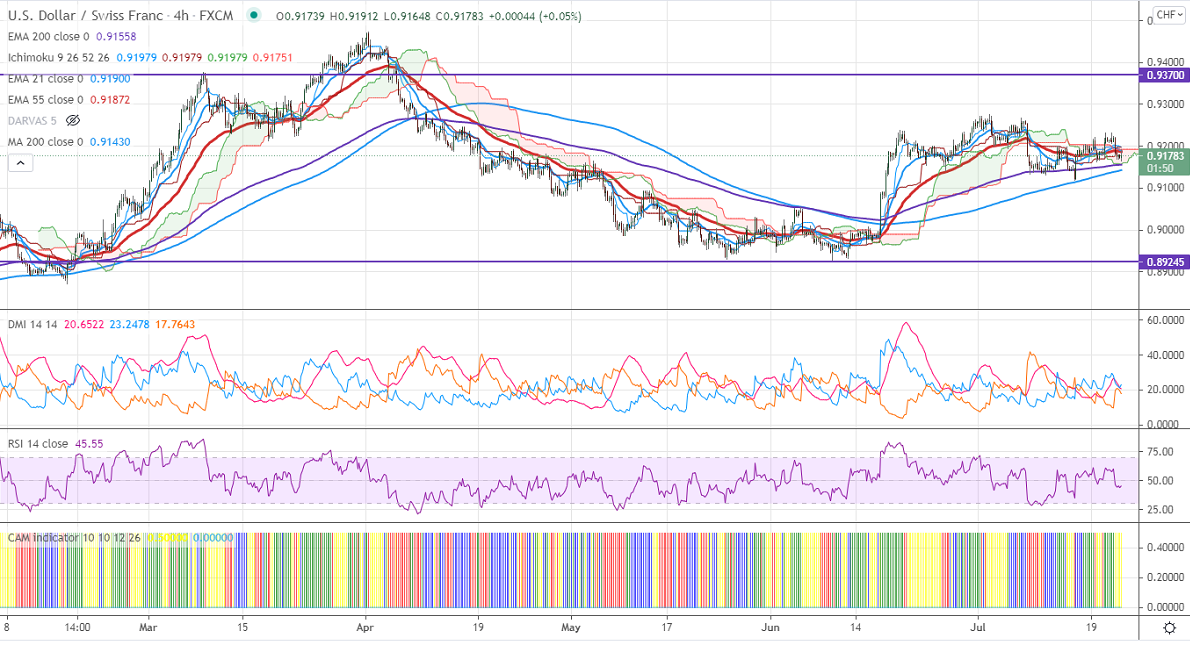

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.91979

Kijun-Sen- 0.91572

This month High– 0.92748

Previous week low- 0.91330

The pair is trading in a narrow range between 0.92750 and 0.91330 for the past four weeks. It was one of the best performers in the previous month and surged more than 300 pips from minor bottom 0.8950. The overall trend is neutral as long as resistance 0.92750 intact. The number of people infected in the US increased by 141% more than two weeks ago, according to the CDC. The US 10-year yield shown a pullback of more than 15% after hitting a 5-mont hlow1.1290%.USDCHFhits an intraday high of 0.91912 and currently trading around 0.91788.

Trend- Neutral

The near-term support is around 0.9150, the breach below will take the pair to 0.9120/0.9059/0.9000. On the higher side, immediate resistance is around 0.92380. Any convincing breach above targets 0.92750/0.93000.

Indicator (4 Hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to buy on dips around 0.9170 with SL around 0.9130 for a TP of 0.9270.