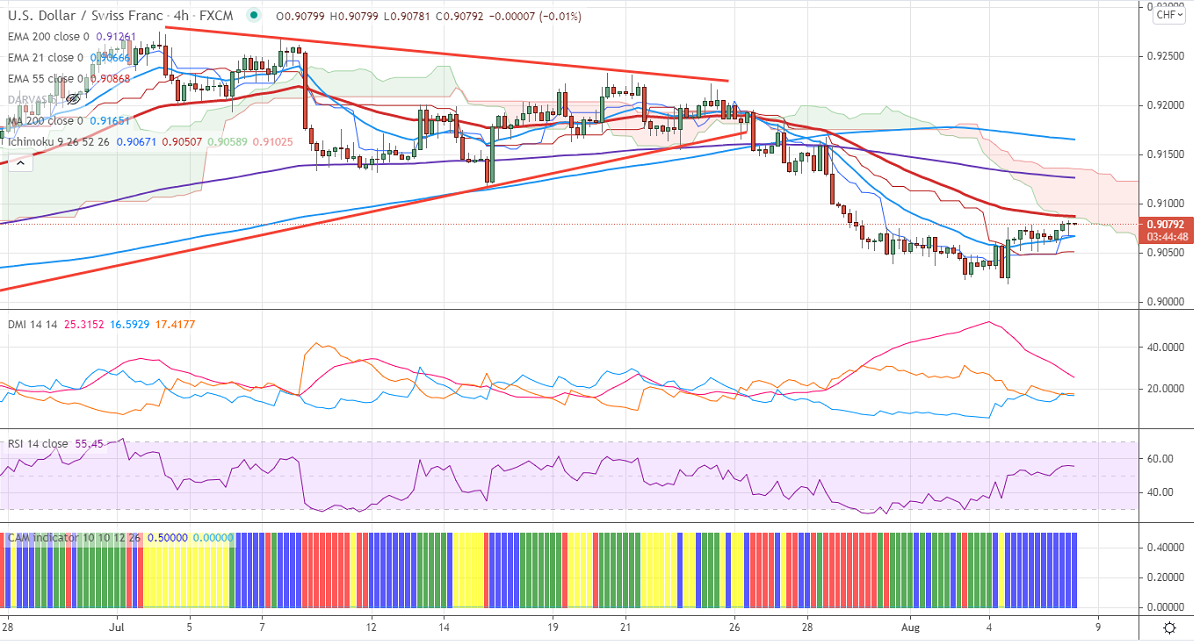

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.90476

Kijun-Sen- 0.90507

Previous week high– 0.92021

The pair has a sharp pullback after hitting a low of 0.90184. The board-based US dollar buying is supporting the pair at lower levels. Markets eye US Non-farm payroll data for further direction. The US economy is expected to add 87000 in July compared to the previous month's 850000. The US dollar gained and holding well above92 level. At the time of writing, USDCHF is hovering around 0.90788, up 0.16%.

Trend- Neutral

The near-term support is around 0.9050, any breach below targets 0.900/0.8925. A breach below 0.8925 confirms that a minor top formed around 0.92750. A dip to 0.8742 is likely. On the higher side, immediate resistance is around 0.91160. Any convincing breach above will take to the next level 0.9128/0.9150/0.9185.

.

Indicator (4 Hour chart)

CAM indicator – Slightly Bullish

Directional movement index –Neutral

It is good to stay away from US jobs data.