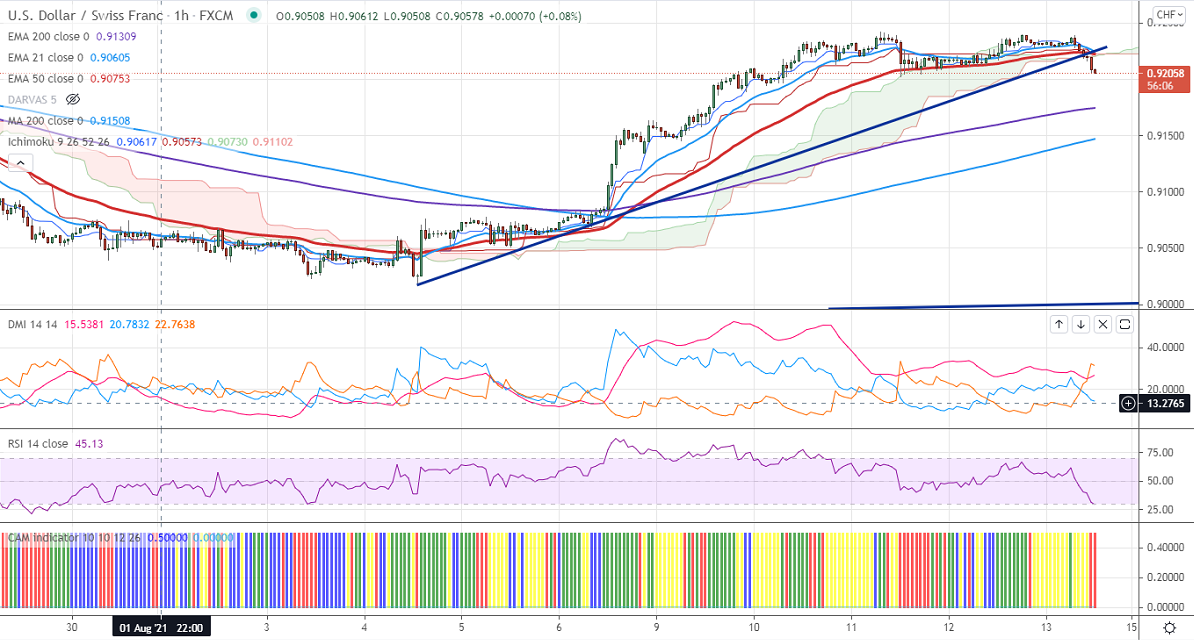

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.92226

Kijun-Sen- 0.92229

June month high– 0.92750

The pair has formed a double top around 0.9240 and shown a minor sell-off. The board-based weakness in the US dollar is putting pressure on this pair at higher levels. The US wholesale inflation surged for a sixth consecutive month. It came at 1% last month compared to a forecast of 0.6%. the number of people who have filed for unemployment benefits dropped by 12000 to 375000 for Aug ended Aug 7th. Markets eye US University of Michigan sentiment for further direction. At the time of writing, USDCHF is hovering around 0.92080 down 0.26%.

Trend- Bearish

The near-term support is around 0.9190, any breach below targets 0.9150/0.91150. Bearish trend continuation only if it breaks 0.8925. On the higher side, immediate resistance is around 0.9240. Any convincing breach above will take to the next level 0.92750/ 0.93000/0.9345.

.

Indicator (Hourly chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to sell on rallies around 0.9218-20 with SL around 0.9250 for a TP of 0.91150.