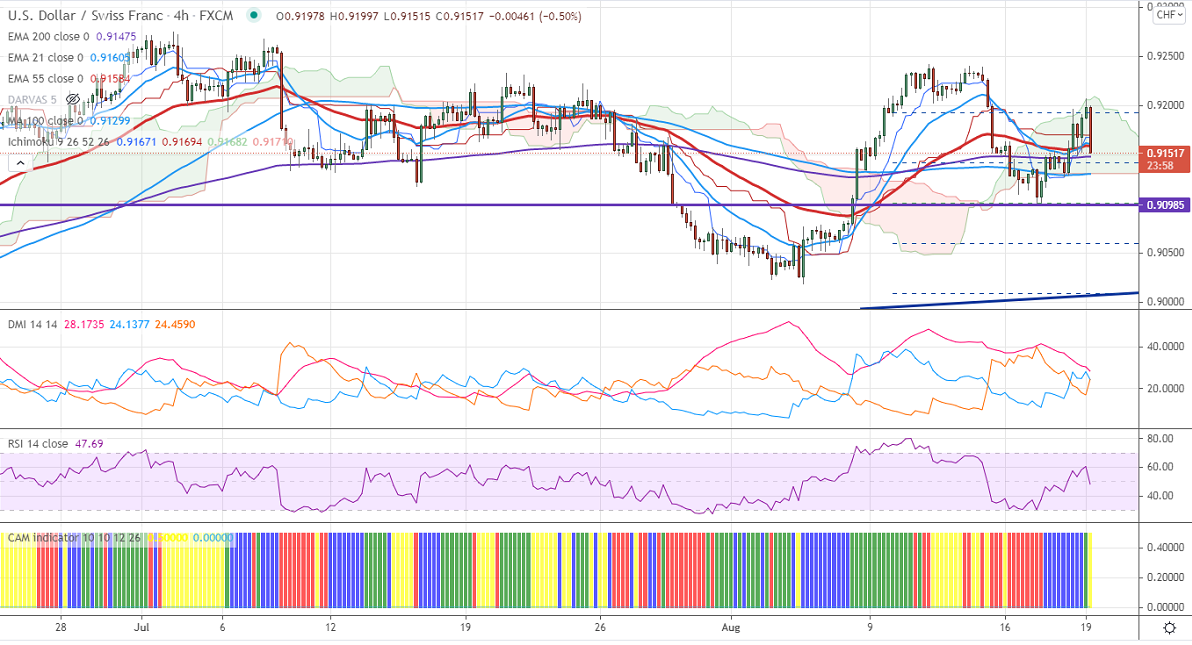

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 0.91671

Kijun-Sen- 0.91694

June month high– 0.92750

The pair surged more than 100 pips on board-based US dollar buying. The minutes show that Fed officials debated about timing and plan to reduce the bond-buying program this year. But some participants felt that "substantial further progress" toward the maximum-employment goal had not yet been met. The US dollar index hits a 4-1/2 month high, any breach above 93.50 confirms further bullishness. Markets eye US Philly Fed manufacturing index and initial jobless claims for further direction. At the time of writing, USDCHF is hovering around 0.91649, down 0.03%.

Trend- Neutral

The near-term resistance is around 0.9025, any breach above targets 0.9240/0.9275. Bullish trend continuation only if it breaks 0.92750. On the lower side, immediate support is around 0.9150. Any convincing breach below will take to the next level 0.91150/0.90750/0.9050.

.

Indicator (4-Hour chart)

CAM indicator –Bearish

Directional movement index –Neutral

It is good to sell on rallies around 0.9218-20 with SL around 0.92750 for a TP of 0.90750.