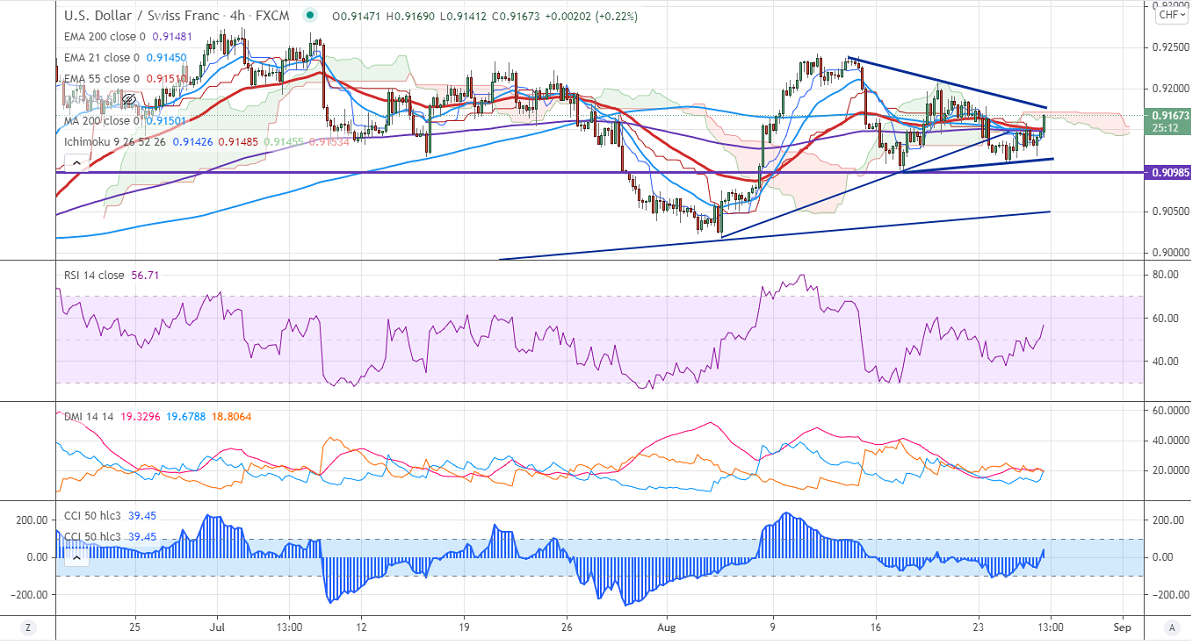

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 0.91370

Kijun-Sen- 0.91502

June month high– 0.92750

The pair has shown a nice pullback of more than 50 pips after hitting a low of 0.91160. It has gone up despite US dollar weakness. The spread of delta variant coronavirus and the Afghanistan political crisis has increased demand for safe-haven assets like the Swiss franc. The orders for durable goods slipped 0.1% last month compared to a forecast of 0.5% decline. The US 10-year yield surged sharply and holding above 200- day MA is supporting the US dollar at lower levels. At the time of writing, USDCHF is hovering around 0.91647, up 0.37%.

Trend- Neutral

The near-term resistance is around 0.91754, any breach above targets 0.9210/0.9240/0.9275. Bullish trend continuation only if it breaks 0.92750. On the lower side, immediate support is around 0.91150. Any convincing breach below will take to the next level 0.90750/0.9050.

Indicator (4-Hour chart)

CCI (50) – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 0.9198-0.920 with SL around 0.92450 for a TP of 0.91150.