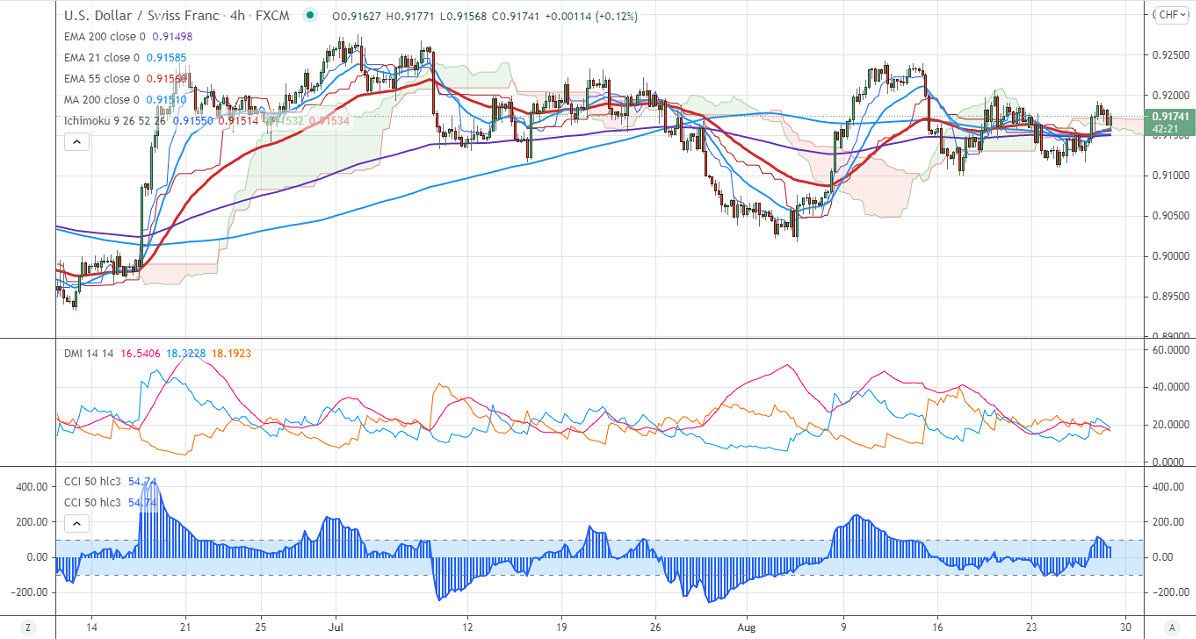

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 0.91550

Kijun-Sen- 0.91514

June month high– 0.92750

The pair is consolidating in a narrow range between 0.91009 and 0.92069 for the past week. Investors remain cautious ahead of Fed Chairman Powell's speech in Jackson Hole Symposium. The US economy grows at a 6.6% annual rate last quarter, slightly better than the previous estimate. The number of people who have filed for unemployment benefits rose by 4000 last week from a revised 349000 previous week. At the time of writing, USDCHF is hovering around 0.91749, down 0.02%.

Trend- Neutral

The near-term resistance is around 0.9200, any breach above targets 0.9240/0.9275. Bullish trend continuation only if it breaks 0.92750. On the lower side, immediate support is around 0.91150. Any convincing breach below will take to the next level 0.90750/0.9050.

Indicator (4-Hour chart)

CCI (50) –Bullish

Directional movement index –Neutral

It is good to sell on rallies around 0.9198-0.920 with SL around 0.92450 for a TP of 0.91150.