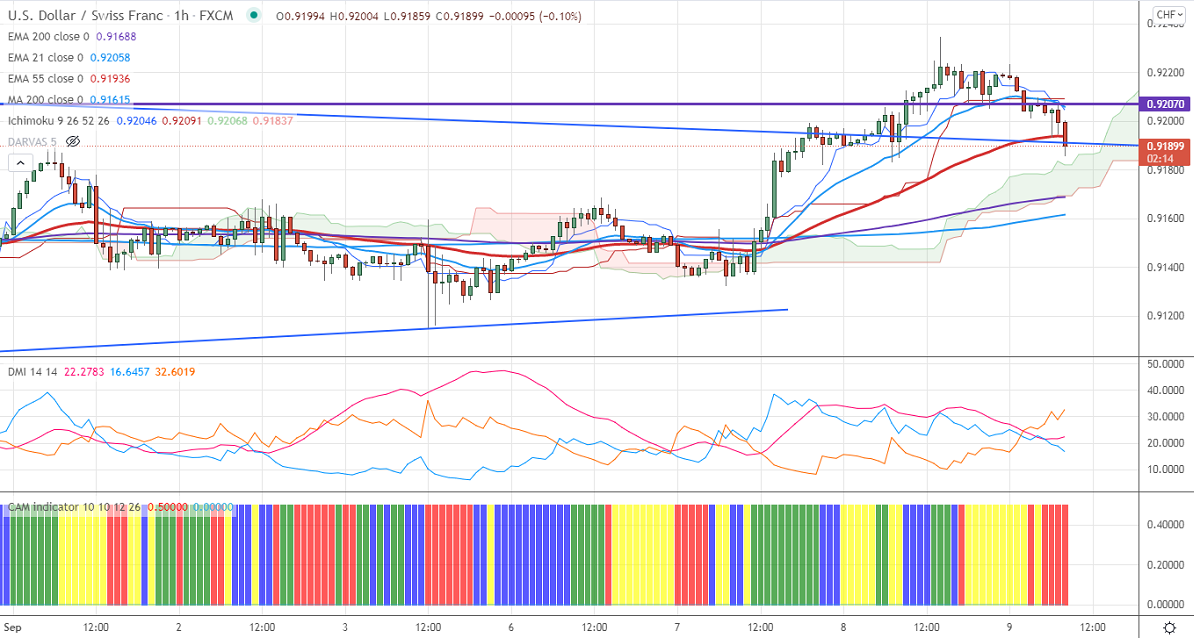

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 0.91659

Kijun-Sen- 0.91573

June month high– 0.92750

The pair is still in the consolidation phase between 0.9098/0.9241 for the past three weeks. It has shown a nice pullback from this week's low of 0.91327 on board-based US dollar strength. The US dollar index spiked above 200-4H MA and struggling to hold above those levels ahead of ECB monetary policy. Any breach below 92.50 confirms intraday bearishness. At the time of writing, USDCHF is hovering around 0.91861 down 0.27%.

Trend-Neutral

The near-term resistance is around 0.9240, any breach above targets 0.9275. The minor bearish trend will get completed only after it breaks 0.9275. On the lower side, immediate support is around 0.91600. Any convincing breach below will take to the next level 0.9135/0.91150/0.9995/0.90750/0.9050.

Indicator (Hourly chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to buy on dips around 0.9160 with SL around 0.9110 for TP of 0.92750.