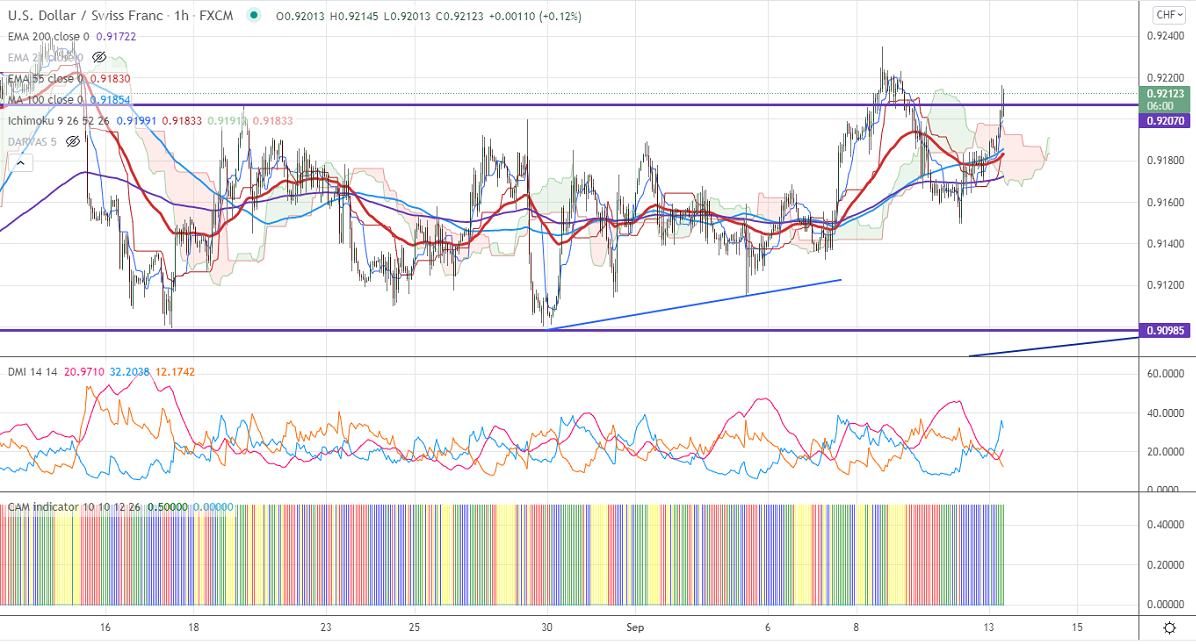

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 0.91981

Kijun-Sen- 0.91833

June month high– 0.92750

The pair recovered more than 50 pips from Friday's low of 0.9150. It is still in a narrow range between 0.90184/0.92748 for the past two and half months. The US dollar index spiked sharply to 92.87 and shown a minor profit booking. Any breach above 92.90 confirms further bullishness. At the time of writing, USDCHF is hovering around 0.92122 up 0.43%.

Trend-Bullish

The near-term resistance is around 0.9240, any breach above targets 0.9275. The minor bearish trend will get completed only after it breaks 0.9275. On the lower side, immediate support is around 0.91500. Any convincing breach below will take to the next level 0.91150/0.9995/0.90750/0.9050.

Indicator (Hourly chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to buy on dips around 0.9160 with SL around 0.9110 for TP of 0.92750.